When it comes to building a college fund for your child, you may often feel like you aren’t doing enough. Many parents share that worry, fretting their son or daughter will carry student-loan obligations like they once did (or still do).

That’s why beginning early matters. The earlier you begin saving, the further your money can grow — especially when you use a tax-advantaged savings vehicle. It can expand your balance far more quickly than a plain old savings account.

Fortunately, an app called UNest can help you get started immediately. Even better: it might help you accumulate up to $25,000 more for your child’s higher education — without adding a single extra dollar out of pocket.

How This App Could Help You Accumulate an Additional $25K

Historically, leveraging a savings plan like this could feel cumbersome — and costly. You would either navigate your state’s website and endure a long sign-up process, or consult a financial advisor, which would chip away at returns with advisory fees.

With UNest, though, you can open a custodial account in about five minutes using your phone. It’s only $3 per month — no convoluted fee tiers, no endless forms, no deep-dive research required. UNest is also a registered investment advisor, so you’re dealing with a legitimate provider.

We ran its calculator to illustrate possible outcomes:

Imagine your child is 4 years old and you contribute $250 per month through UNest. By the time they reach 18, you could have more than $68,000 saved up, ready to cover college or vocational school tuition, housing, textbooks and even a new laptop.

That’s roughly $25,000 more than you’d have if those contributions sat in a savings account, which would end up around $43,000.

Typically, plans like these restrict withdrawals to education expenses or impose penalties for other uses. UNest, however, allows your child to access the funds for a variety of major life events — not just college. They can use it toward a first car, a home down payment or even a wedding.

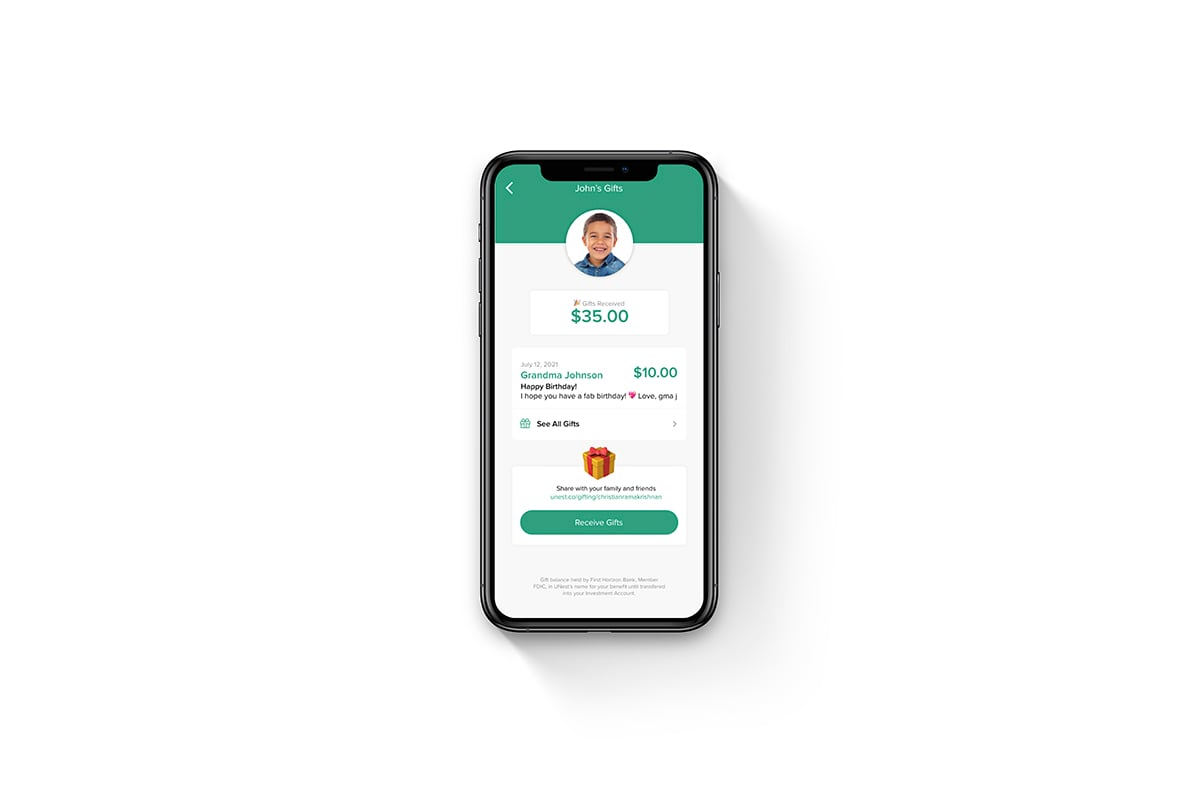

One standout UNest option is inviting friends and relatives to contribute to your child’s investment for birthdays, holidays and other milestones. It’s very straightforward, and those gifted sums can benefit from compound growth over time.

To begin, download the UNest app. You’ll complete a few basic details and UNest will recommend the most suitable savings strategy based on your child’s age and estimated needs.

After that, it’s just $3 a month and you’ll schedule your recurring deposits; you can start with as little as $25 monthly. The portfolio automatically shifts as market conditions change, so it genuinely becomes a set-it-and-forget-it solution.

And by spending only five minutes on this now, you could be on track to save an extra $25,000 for your child’s education, thanks to tax perks and investment returns. Pretty solid deal, right?

Jordan Meyers is a staff writer at Savinly.