Why Budgets Feel So Hard

What Trips Us Up, Really?

Okay, let’s be honest for a second—most of us have already blown a budget. Or maybe we’ve never made one that actually stuck for more than, oh, a week? If you get to the middle of the month and think, “Wait, where did my money go?!”, you’re definitely not alone.

Here’s a wild truth: being “bad at money” isn’t a personality flaw. It’s just… normal. Most people never learned how to do a budget that fits real life. They go too strict, panic over every latte, and then just give up by week three. (I see you—I’ve done that, too.) Trouble is, without something guiding your spending, even a good income can just vanish. Like socks in a dryer… where do they all go?

What the Ramsey Approach Gets Right

So, how does the Ramsey classroom chapter 3 post test fit into all this? Ramsey doesn’t treat budgeting like punishment. It’s more like—let’s grab the steering wheel and actually drive, instead of letting your bank account swerve everywhere.

Ever tried to “just wing it” and hoped there’d be money left at the end of the month? Oof. That’s what Ramsey’s Dave ramsey Chapter 3, LESSON 1 works to fix. The goal is a plan that actually holds up to real-life stuff… like surprise car repairs or way too many pizza nights.

Personal Blunder Alert: Coffee Edition

A friend of mine (let’s call her Jess) once said, “I don’t buy expensive stuff, so why am I always broke?” She finally tracked her spending for a month—just one month!—and discovered she spent over $170 at coffee shops. Turns out little leaks sink big ships. She switched to homemade cold brew and started socking those savings into, you guessed it, her emergency fund.

Chapter 3: Where Money Gets Real

What Does Dave Teach Here?

This part’s the heart of why Ramsey classroom chapter 3 post test matters. Chapter 3 digs into the grit of handling cash day-to-day—and lays down some rules that make adulthood a lot less painful.

The very first thing Dave pushes is the emergency fund. (Seriously, if you remember nothing else, remember that tiny bunker of cash can save your butt!) The the first foundation is: save—and it’s for life’s “uh-oh” moments, not next year’s tropical vacation.

Some Questions The Post Test Hits

- What’s the real reason to have $500 (or more) stashed away?

- Is it okay to use that fund for a sick sneaker sale, or is that missing the point?

- How do you decide what’s truly an emergency, and what’s just… poor planning?

You’d be surprised—almost half of Americans can’t cover a $1,000 emergency without freaking out. That’s what the post test shines a light on: it’s not about being the richest, it’s about being ready.

Zero-Based Budgeting: Why Bother?

I used to hear “budget” and picture dusty spreadsheets and giving up fun. But zero-based budgeting (yep, it’s in the test) is weirdly freeing. Instead of saying, “Cut this, cut that,” you get to tell your dollars exactly where to go—like a little army, all with jobs.

Quick Comparison Table: Old School Vs. Zero-Based Budgeting

| Approach | Where Money Goes | Flexibility? | Ramsey Style? |

|---|---|---|---|

| Old School | Whatever’s left, if anything | Low | Nope |

| Zero-Based | Every single dollar gets a plan | High (things change, so does your plan) | Heck yes |

If you want some extra inspiration, Dave ramsey Chapter 3, LESSON 1 is a goldmine for stories about people turning chaos into calm with this one idea. Got a couple weird expenses coming up? You just tweak your categories and move on. Me? I started saving for Christmas in July—because gifts don’t have to be a surprise for my wallet.

Can You Beat Inflation?

The Infamous Post Test Snippet…

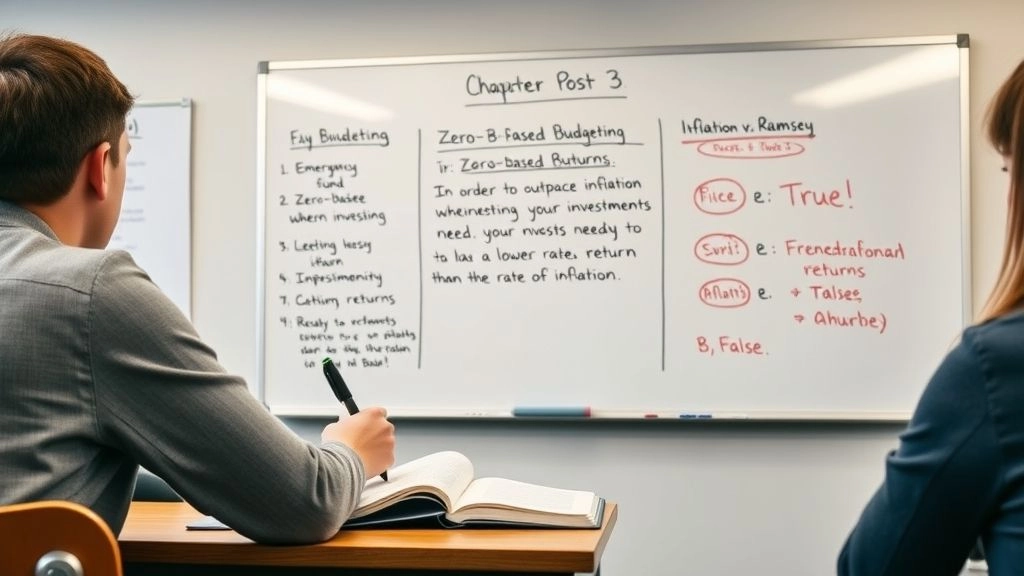

There’s one question from the Ramsey classroom chapter 3 post test that always trips people up:

“In order to outpace inflation when investing, your investments need to have a lower rate of return than the rate of inflation. a) True b) False”

Hint: It’s False! If you don’t earn more than inflation, your money actually shrinks, even though the number on your bank app goes up. Sneaky, right?

What Inflation Does To You

Have you ever felt like your paycheck stretches less every year, even if you got a “raise”? That’s inflation chewing away at your buying power. Basically, a dollar today won’t buy the same pizza next year (bigger bummer: it’s the same with rent, gas, and streaming services).

So… learning how to invest smart (once you’re past step one, that is) is what keeps your savings alive and kicking. That’s why the what is the fourth foundation of the dave ramsey course? is all about investing. And—fun twist—you don’t need a finance degree to get started. Just a plan and consistency.

A Little Story About Ignoring Inflation

Quick share: my cousin left $2,000 in a basic checking account for seven years. (No judgment, we’ve all been there.) When he went to use it, the money was still there…but stuff that cost $2,000 before—car repairs, rent, everything—had gotten way more expensive. He felt cheated by time. Lesson learned? Don’t just save, grow your savings.

Costly Money Mistakes (And How To Dodge Them)

The Fee Sneak Attack

Heads up: if you’re ever tempted to say, “I’ll just pay my bill a few days late, no biggie”…staaaahp. Did you know if you make a late credit payment, you might see the lender add fees that seriously mess with your progress?

It’s like that game where you knock over one domino, and suddenly all your careful budgeting crashes down. I once forgot my electric bill on vacation—came home, found a $38 late charge. And you know what? That $38 could have been a night out, a tiny emergency fund boost, or (let’s be real) ten pints of ice cream. Never again.

Quick Save: Set It and Forget It

- Make all your essential bills automatic. Like, today.

- Set up alerts for “oh no” moments—in case your phone tries to sneak past Wi-Fi use (see, I learned from Charles in this totally relatable scenario).

- Keep a “buffer” line in your budget, just in case. Life happens fast.

Late fees aren’t just annoying—they’re distractions from real goals, like saving up for your emergency fund or finally taking that debt snowball seriously.

Is That Really An Emergency?

Here’s a challenge—try answering honestly: what’s a true emergency? A $475 car bumper repair? Maybe. A $225 designer backpack that just happens to go on sale? Erm… probably not.

When life happens (and wow, does it ever), you want your emergency fund standing guard. As the first foundation is: save says, it’s your shield, not a shopping spree fund.

Get Ready to Crush the Post Test

How To Practice For Real Life

No joke, you don’t have to memorize rules to win at money. What helps? Living them. When you prep for the Ramsey classroom chapter 3 post test, focus more on how you’d use the info, not just what the answers are.

Sample Must-Knows: Table Edition

| Term | What It Means | Why It Matters |

|---|---|---|

| Sinking Fund | Saving a bit every month for a known, big cost | Prevents panic and last-minute debt |

| Debt Snowball | Paying off tiny debts first to build motivation | It helps you see actual wins and stick with it |

| Zero-Based Budget | Every dollar gets a job each month | No waste, more control |

So when they ask things like, “What should you save up for first?” you’ll know: emergency fund. Or “How do you avoid late fees?”—by planning and automation. Simple moves, but the payoff? Huge.

Quick Story: Budget Win

One of my proudest moments was when a reader messaged me after tackling the Ramsey classroom chapter 3 post test. She realized that by finally ditching her cable bundle (okay, so it was mostly reality shows), she saved $95/month. She put that money toward her rainy day fund—and, as she said, “It feels like I’ve been giving myself a raise this whole time!”

Go ahead, root for yourself. You can outsmart your bills, too.

Looking Ahead: What’s Next?

Linking It All Up

One thing people forget? These steps build on each other. Once you’ve built your emergency fund, what’s next? Take a peek at what is the fourth foundation of the dave ramsey course?—it covers stepping into investing with the same confidence you just found in budgeting. The cool thing: you’re not just surviving, you’re really moving forward. (And trust me, seeing savings grow is weirdly addictive!)

Ready To Take The Wheel? (You’re Totally Capable)

So, here’s the deal. The Ramsey classroom chapter 3 post test isn’t just a quiz you check off. It’s permission to admit, “Yeah, money’s messy, but I’ve totally got this now.” Through chatting about real-life mess-ups, learning how to dodge those sneaky fees (if you make a late credit payment, you might see the lender add charges), and finally making that emergency fund happen, you’re on your way to way less stress—and way more freedom.

If you’re reading this nodding along, grab a piece of paper and your last bank statement today. Track what flew out of your account—every coffee, every autopay you forgot about, every “I’ll just get takeout.” Try the zero-based approach, move just $20 into a savings account, and see how it feels. Take the actual Ramsey classroom chapter 3 post test again, just for kicks. Bet you’ll surprise yourself.

And if you’ve got a story—maybe about how Dave ramsey Chapter 3, LESSON 1 connected to your real life, or how the first foundation is: save helped you sleep better at night—drop it in the comments. We’re all in this together, learning as we go (and, honestly, laughing at the silly mistakes, because hey, if you can’t laugh, what’s the point?). You absolutely have what it takes. Let’s do it.