Rent’s Not the Villain

Ever heard someone sigh, “Rent just throws money away”? Yeah… I get it. It stings to see that chunk of your paycheck vanish, month after month, while your buddy is picking out paint swatches for his new place. Still, let’s bust a myth right from the start: renting doesn’t mean you’re stuck or that homeownership is lightyears away. It just means you have to be clever—sometimes a little scrappy—about your money habits.

When I first realized how much of my own money went to rent and tacos, I nearly choked on my latte. But here’s the real story: tons of renters figure out how to save for a house while renting—without giving up all fun or living in a shoebox. The secret? Tweaking your habits, not torching your lifestyle.

Track Your Biggest Leaks

Why Does It Feel Impossible?

Let me guess… Between rent, bills, groceries, and just living, it feels like there’s nothing left to save. But have you ever truly tracked your spending? Not just the boring bills, but all those “harmless” spendy habits hiding in plain sight?

One weekend I did a reality check. Coffee shops, rideshares, streaming services—it all added up fast. A little embarrassing, honestly. But this wasn’t a scolding moment. It was more like, “Oh, that’s where my future deposit went.”

Table: Sample Monthly Spending Leaks

| Expense | Monthly Cost ($) | Annual Savings if Cut |

|---|---|---|

| Takeout (2x/week) | 80 | 960 |

| Streaming (3 services) | 36 | 432 |

| Ride-hailing (weekends) | 60 | 720 |

| Fancy coffee runs | 40 | 480 |

Now, I’m not saying you need to axe everything. But if you reallocate even half of these “leaks,” that’s $100–$150 heading straight to your house fund each month. And you barely feel it.

Roommates and Downsizing: Messy, But It Works

If someone told me at 25 that getting a roommate would be my best financial move, I’d have rolled my eyes. But hear me out…

Rent’s your biggest bill. Split it, and suddenly you’re not just saving $500 a month—you’re running faster toward that down payment. Yes, sometimes you’ll have to hear about their broccoli in the microwave, but think about what you’ll do with that extra cash! Moving to a slightly smaller place, or a different (but still safe) part of town, can free up hundreds more.

More than one friend of mine made this leap. One moved in with her sister for a year—not forever, just long enough to save $7,000, bringing her dream closer by years. If you want numbers, the average down payment is about 13%—often less than you’d expect (data on down payments).

Sneaky Budget Wins

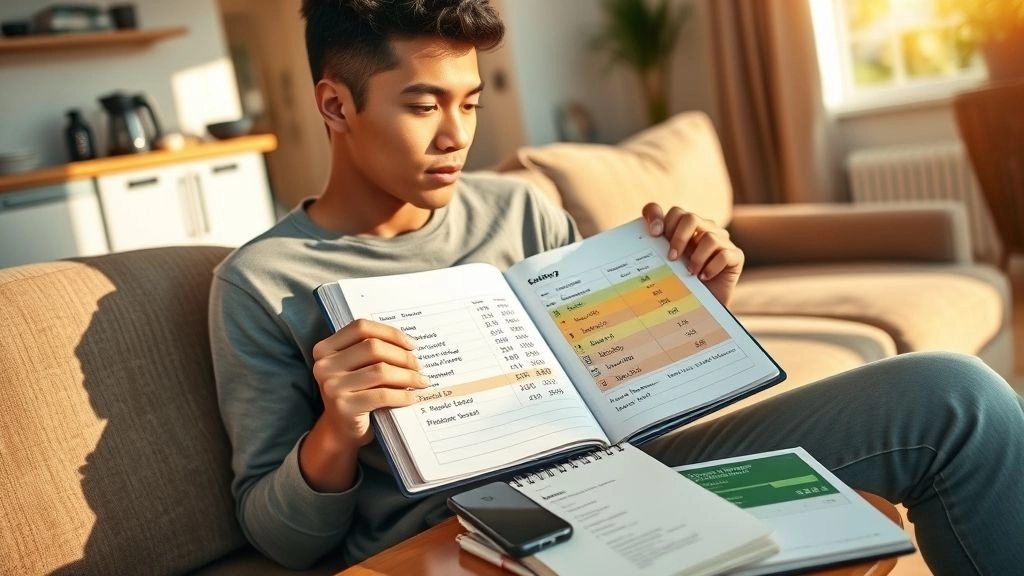

Make Budgeting Painless (Promise)

Let’s get real: budgeting is about as appealing as cardio in August. But it’s not punishment. It’s just… telling your dollars where to go, instead of asking at the end of the month, “Where did it all go?”

I used the 50/30/20 rule but solved for laziness by automating most of it. That means: 50% for needs (yay, rent), 30% for wants, 20% straight to savings and paying down debts. Here’s where it gets sneaky: if you regularly redirect “wants” cash to saving for your house, you don’t actually feel the pinch.

Need a hand, especially if your budget’s tight? Here’s a great guide: how to save money for a house on a low income. There’s zero shame in starting small if that’s what you’ve got. Money saved is money saved.

Automate All the Things

If you only remember one thing from this post: automate your savings. Moving the money before you can spend it—game changer. Set up transfers to a separate account the morning after payday. Make it hard to touch, easy to watch grow.

And here’s where to stash your house fund: somewhere that pays a little, but you can still get it when you need it. High-yield savings? Sure. Or, check out this list of options at where should I keep my money while saving for a house. It’s all about “out of sight, out of mind”—until one day, boom, you’ve built an actual down payment.

Side Hustles and Stuff Sales: The Real MVPs

When my bank account felt stuck, side gigs brought hope. Delivering groceries, tutoring, dog-walking—whatever fits your schedule. My friend Jess flipped thrifted jackets online and made an extra $250/month. It’s not glamorous, but you’ll remember what that money can become.

Not into hustling every weekend? Sell old electronics or clothes you don’t even wear anymore. Clearing out your closet or cabinets can kickstart that house fund quickly.

Debt… That Elephant in the Room

Is Debt Holding You Back?

It’s a gross topic, I know. But managing debt—especially high-interest stuff—will free up mental space and actual dollars. The more debt you knock out, the easier it is to save and eventually snag a mortgage. Lenders care a lot about something called your “debt-to-income ratio”—basically, how much you owe vs. how much you make (tips on DTI and credit).

Try this if debt seems wild: list everything you owe, and tackle either the smallest balance (for quick wins) or the highest interest (for long-term savings). Watch your monthly obligations shrink—and your house savings speed up. You’re in charge here.

Dream Big, Goal Smart

Set An Actual Target

Most folks don’t realize this: you often don’t need 20% down for your first house. Some programs start at just 3%. If the median down payment is $24,000, what’s your number? Depending on your city, it could be less (or more), but the real magic is… break up the goal.

Saving for a house in five years? That’s $400 per month. Six months? Well, that’s another game, but it’s still possible—especially if you get relentless with budgeting and snag some extra income around the edges. You can read more about different timelines (and the hustle needed for each) at how to save for a house in 5 years or how to save for a house down payment in 6 months.

Grants, Gifts, and Realistic Help

If you’re low on time or patience, don’t forget: most states have first-time homebuyer programs—grants, special mortgages with lower down payments, maybe even forgivable loans. Even family gifts count if they’re documented right. A little research into available programs (seriously, Google + your state), and you may cut years off your savings journey. Don’t be shy about using what’s there for you.

Staying Sane While You Save

Cutting Back Without Hating Life

Here’s the trick: don’t go “no-spend” cold turkey unless you want to rage quit. Look for easy swaps instead. Love takeout, but hate the cost? Rotate in cooking one more meal a week. Obsessed with streaming three different platforms? Pause a couple for a few months (your shows will wait).

One friend kept her Friday coffee treat, but cut her subscriptions. Another skipped bars but budgeted for one nicer dinner out a month. The secret isn’t deprivation—it’s making the money you do spend feel worth it. Frugality and fun can coexist. Who knew?

Big Wins from Small Wins

When saving for something huge—like your own roof—you might not see big changes overnight. That’s ok! Celebrate each month you keep your budget. Every $100 moved into savings is $100 closer to your place, your rules, your weirdly specific kitchen paint color.

I set up a dumb little chart on my fridge. Every time I added $500 to my savings, I colored in another square. Yes, it felt childish. Also yes, it felt awesome. Give yourself credit—literally and figuratively. These small wins? They snowball fast.

Putting It All Together

So, if you’re still wondering how to save for a house while renting… There’s no single, magical hack. It’s the sum of tiny choices: track your leaks, split that rent, automate every possible step, knock out high-interest debt, grab every little win, and use the right accounts (trust me, check where should I keep my money while saving for a house for safe, smart places to grow your stash).

You don’t have to be perfect, and you definitely don’t have to be rich. But you do have to start. What would it feel like if, five years from now, you were house shopping instead of just “window shopping”? Or even sooner? If you try one tip from this post, track your results for a week. Trust the process—even if it feels slow. People just like you do this every day (messy, imperfect, but moving forward). So—what’s your next move?

If you’ve got a story, action step, or vent (hey, we all need to vent), drop it below or share with a friend. Let’s cheer each other on. Your future front door is closer than you think. Keep saving, keep dreaming—and keep it real.