Why Free Cash Matters

Okay, let’s just say it: being a student is kind of like trying to win a marathon while juggling flaming textbooks. (Why is campus food so overpriced? Why does rent eat half your loan?) Most people will tell you to “just budget better.” But, honestly…have you ever made a spreadsheet, felt proud for ‘adulting’, then watched your balance vanish the second the semester kicked in? Yeah—budgeting matters, but tiny, free wins can make all the difference between living off instant noodles and actually buying a coffee once in a while.

Think “free money” just means hoping for a fairy godmother? That’s where everyone gets it wrong. Some of the best free money hacks for students are right there—hidden in the stuff you already do, or in things you’re ignoring (like that embarrassing school email account you never check). Ready? Let’s hunt down every last overlooked dollar with hacks that actually work. Spoiler: you don’t need to be a “Money hacker movie” genius to score a win or two.

Scholarships No One Talks About

Is There Really Free Money Out There?

Short answer: yep. Ignore the people who act like scholarships are only for valedictorians or Olympic-level chess champs. Honestly, weird scholarships exist for everything—left-handedness, duck-calling, even your last name. I’m not joking! I once met a guy named Zolinski who got $750 just for having that surname. (Am I a bit salty about my super-average name? Maybe!) But the main thing here: scholarships and bursaries are not just for geniuses or people “in need.” They’re for anyone who actually looks for them.

How Do You Find Them?

Search engines are your best friend here, and so are lists at your school’s financial aid office. Sites like Save the Student have whole sections on ways to get free money—not just the basic student loan. Take 20 minutes. Fill out something weird. What’s the worst that happens? You lose ten minutes, but sometimes, you wake up to $500 in your account for “demonstrating kindness.” (That was an actual scholarship at my campus. No, I didn’t win. Yes, I’m still confused.)

Scholarship vs. Part-Time Job: Which Pays More?

| Option | Hours Needed | Avg. Money | Actual Work? |

|---|---|---|---|

| Scholarship (1 app) | 2-4 | $500-$2,000 | Only application |

| Campus Job (per week) | 8-10 | $80-$150 | Ongoing |

Look, I’m not saying skip the job if you want one. But never underestimate the ROI on a single, odd scholarship. Seriously.

Sign Up, Show Up, Score Big

Do Sign-Up Bonuses Really Work?

You know all those pop-ups when you shop online? Yeah, some are annoying, but sometimes, signing up nets you a $10 coupon or freebie for something you were going to get anyway. Multiply that by every streaming, food delivery, and retail app out there…and suddenly you’ve got movie night paid for without spending a dime.

Same goes for banks—many offer cold hard cash for opening a student bank account or switching providers. My friend Maddie joined a bank, got $75, and never looked back. Of course,read the terms first so you’re not stuck with silly rules or fees. Small tip: always set security up properly. Avoid drama like Bank account hacked through phone number situations. (Because free money is great—but losing your rent fund to a scammer? Not so much.)

Are Referral Codes Worth the Hype?

Short answer: totally. Got a friend who still banks with their hometown credit union? Or someone who hasn’t installed that cashback app? Many companies will toss you $10 or even $50 just for inviting a friend. I once paid for a whole week of groceries using referral and sign-up bonuses from banking apps and food delivery credits. Seriously. It’s not a pipe dream—just pays to be a little nosy.

Your Student Card: The Hidden Goldmine

What Discounts Are You Missing?

Your student ID isn’t just to prove you’re a real student at campus pubs. It’s basically a magic key. Flash that card and you get 10-20% off at loads of big-name stores, streaming services, tech subscriptions, food spots—sometimes even travel discounts. Ever bought train tickets? With a student rail pass, I once got a $30 fare down to $21…and I was just going home for the weekend (research on college savings backs this up).

Most big companies have a student program hiding somewhere in the small print. And, weirdly, sometimes they forget to advertise it. Always ask, in person or in the checkout process. Best case? You save money. Worst? You get a free “no.” (And, honestly, students are immune to awkward already.)

Which Freebies Should You Actually Chase?

Let’s not kid ourselves—some “freebies” are junk. But sometimes campus clubs, fairs, or events mean free pizza, USB drives, or even books. I once scored all my math textbooks secondhand at the campus “Free Store.” Saved me more than $200. Just… show up. That’s usually all it takes.

And yes, absolutely, there are stories that sound straight out of a Money hack real life film—like the time someone won a grocery gift card just for answering a survey about cafeteria food. Stuff like this? It’s worth two minutes.

Student Savings Table

| Discount Type | Potential Annual Savings | Effort Level |

|---|---|---|

| Tech subscriptions | $120–$360 | 5 min to sign up |

| Retail/apparel | $50–$100 | Show ID at checkout |

| Streaming bundles | $60–$120 | Activate student pricing |

| Train & bus fare | $100+ | Use student code/book early |

Side Hustle or Freebie?

When Is a Job Not Really “Work”?

Alright, let’s be real: not all side gigs are created equal. But sometimes you can earn a little “free money” for doing things you’d do anyway. Here’s the trick—look for the hacks that feel more like life upgrades than chores.

Maybe you love dogs? Walk pets while listening to podcasts. Like tutoring? Lots of first-year students shell out for quick homework help. Or, hey, did you know some banks and apps give you bonuses for simply using them—no hustle, just existing. In the best-case scenario, it’s like you’re getting paid just for being you.

Want a laugh? My roommate once did a sleep study at the med school. Paid $300 for “studying” (aka napping in a lab for a night). Best paycheck ever.

Gig Comparison Table

| Side Gig | Payout | Best For | Can You Study? |

|---|---|---|---|

| Tutoring on campus | $15-$25/hr | Helping with homework | Yes (during downtime) |

| Dog walking | $10-$20/hr | Animal lovers | No, but it’s exercise |

| App sign-up bonuses | $5-$50 (one-time) | Everyone | Always |

What About Cash From Apps?

So many apps swear they’re the next big thing in free money. Reality? Stick with bank or cashback apps that pay you just for using them—don’t fall for anything sketchy, especially those claiming to be a Money hack Mod APK. If it sounds like you’d see it in a weird “Money hacker movie,” run the other way. If there’s an easy, low-risk bonus (like, “Install and earn $10”), why not take it? Just make sure you’re not giving away more than you get.

Budget-Friendly, Not Boring

Does Budgeting Have to Hurt?

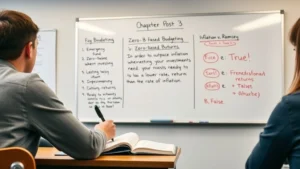

Here’s the honest truth: most budgeting advice is either too strict or too fluff. What actually works? Simpler than you think. Try setting up weekly “cash envelopes”—physically separate out your spendable money, so you don’t accidentally blow your food money at a Thursday night pizza party. Or, better yet, automate savings (even just $5/week). These tactics aren’t revolutionary, but they work. You’ll feel more in control… and not like you’re living in a finance spreadsheet.

Tiny Tweaks Add Up

My freshman year, I realized buying a supermarket footlong, splitting it, and making it lunch and dinner saved me $6 a day. Seems tiny, but over a semester, that’s hundreds of dollars just from being a little strategic. That’s textbook cash—for literally zero extra effort. Collect those little daily wins—they compound quietly in the background.

And hey, if you still feel like free money is a myth, peek at other people’s stories (trust me, even “lucky” students are just good at noticing opportunities). Sometimes it really is that simple. Check out wild tales like Money hack real life to see how even regular habits can become money-saving hacks.

Risks, Red Flags, Reality Checks

Are All “Money Hacks” Safe?

Let’s say it softly—some downloads that promise quick cash can backfire. The last thing you want is your bank account hacked through phone number stunt or some shady “Money hack Mod APK” draining your real balance. My rule of thumb? If your gut says “uhhh…”, listen. Good hacks are easy, legal, and don’t require you to download anything weird or hand over secret codes.

How to Spot a Bad Deal Fast

If any offer asks for your Social Security number, full address, or banking info before you’re sure they’re legit, walk away. You’re not missing out—you’re avoiding drama.

Legit “free money hacks for students” don’t make you jump through 20 hoops or feel like you’re on the sketchy side of a Money hacker movie. If people in the subreddit roast it, skip it.

Wrapping Up—Start Small, Win Big

Okay, that was a lot! But if you’ve made it this far, here’s what you need to know: real free money hacks for students are honestly just about noticing the stuff that everyone else skips. Claim that obscure $200 bursary. Pocket the free coffee from campus events. Double-check that student discount before you tap “Buy Now.” Score app bonuses, and protect yourself—don’t fall for anything that looks like a money hack Mod APK ad from the wild west.

Remember, the little wins add up. Over a year, they can mean the difference between going home strapped for cash or actually affording a treat or two (maybe even a guilt-free coffee run?). Start with one or two of these hacks—build the habit. After all, you came to this post looking to win, right? So, which free money hack are you about to try first? Let me know below (I want to hear your weirdest wins and best mistakes). The earlier you start, the more you squeeze out of those “broke college years”—and maybe, just maybe, free money will find its way to you too.