You ever get to the end of the month and wonder, “Where did all the money go?” Trust me, you’re not alone. Between the kids, bills, groceries, and those sneaky little extras (hello, daily coffee runs), it can feel like your wallet’s on a rollercoaster you didn’t sign up for. But here’s some good news: making a simple family budget doesn’t have to be a headache or a spreadsheet nightmare. In fact, it can be the thing that finally gives you some peace of mind—and maybe even helps stash away a little cash for life’s surprises.

Stick with me here. I’ll show you how to make a simple family budget that actually works—for real life, for your family. And hey, no fancy finance degree needed.

Why Bother?

Are You Really In Control?

Have you noticed how easy it is to lose track of where your money goes? It’s like trying to hold water in your hands—the more you try, the more it slips away. Especially when you have a family, it’s super tempting to just “wing it” and hope for the best. But budgets aren’t just about strict rules; they’re about giving yourself a little freedom. Freedom from stress… freedom from surprise bills… freedom to plan a vacation or save for college.

According to research on spending habits, families who track their income and expenses regularly report feeling more secure and less overwhelmed. Budgeting is the anchor in the chaos.

Build Your Safety Net

One of the biggest perks of having a plan? Building that emergency fund. If you don’t have one yet, try aiming for enough money to cover 3 to 6 months of your family’s expenses. Sounds scary, right? But even saving a little bit each month adds up. What is a normal family budget? usually includes setting aside cash just for those “uh-oh” moments, so you’re prepared without panicking.

Count Your Income

List Every Cent

Okay, first thing: get all your money sources on paper. I mean everything—your paychecks, your partner’s, side gigs, any regular child support or alimony, even the odd garage sale or cashback rebate. This is your “money in” column—sort of your financial starting point.

If your income varies, pick a low estimate to start with so you don’t overspend. You can always adjust it as the month goes on. It’s about being realistic, not perfect.

Example Table: Sample Family Income

| Income Source | Monthly Amount |

|---|---|

| Main Salary | $4,000 |

| Partner’s Salary | $3,200 |

| Side Gig | $300 |

| Total Income | $7,500 |

Track The Outflow

Needs vs Wants

Here’s where it gets juicy: what’s really essential, and what’s just nice to have? Separating “needs” like rent, utilities, and groceries from wants like streaming services or eating out helps you spot where you might trim a little fat.

Something I’ve found super helpful is tracking every purchase for a month—or at least a few weeks. This can be eye-opening. Like, realizing that your kid’s daily snack run adds up to $50 a week. Yikes.

If you want a solid reference, check out What is a normal family budget? It gives a good idea of how average families break down their needs and wants.

Monthly Family Budget Example

| Category | Budgeted | Actual |

|---|---|---|

| Groceries | $800 | $750 |

| Utilities | $300 | $325 |

| Kids’ Activities | $150 | $160 |

| Entertainment & Dining | $200 | $210 |

| Savings | $500 | $500 |

| Total | $1,950 | $1,945 |

Set Goals That Matter

Dream Together

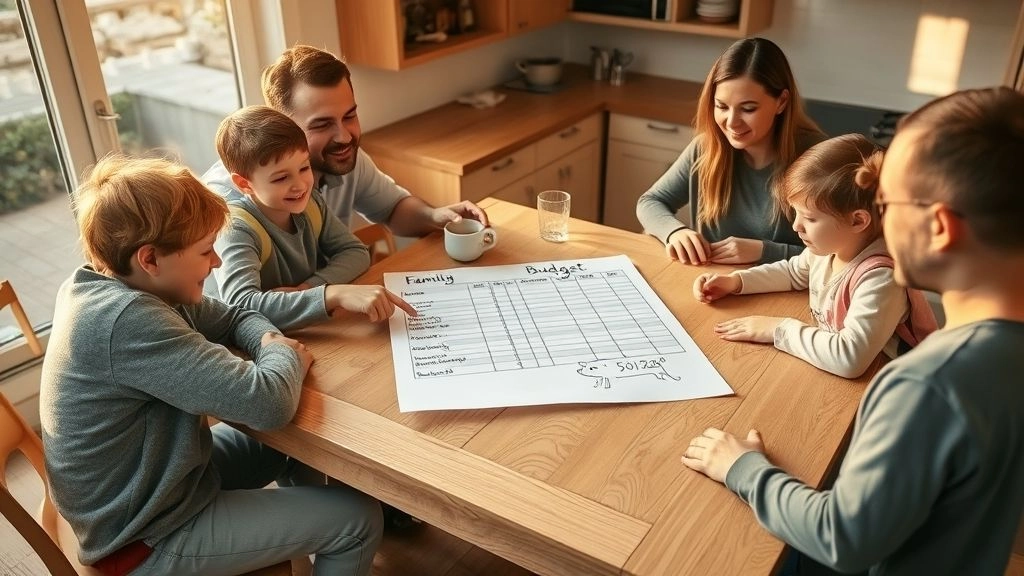

One thing that changed budgeting for my family was making it a team sport. We sat down, talked about what we all wanted—whether it was saving for college, a family trip, or paying off debt. Having shared goals makes it easier for everyone to stay motivated.

What About the Kids?

Even young kids can join in with simple money lessons. Ever heard of What is the 50 30 20 budget rule for kids?? It’s a great way to teach them how to divide any money they get (allowance, gifts) into spending, saving, and sharing. It’s like giving them a mini budget to manage their own cash and build healthy habits early.

Build Your Blueprint

Match Income to Expenses

Now, the fun math: subtracting your expenses from your income. If your expenses are higher, don’t panic. This is where you get to play with the numbers and make choices. Maybe cut back on subscriptions, switch to a cheaper phone plan, or rethink those weekly takeout dinners.

Try out the What is the 50/30/20 rule budget? framework to balance your family’s needs, wants, and savings—a super simple guide that covers the big picture without drowning you in detail.

Monthly family budget example: Sample breakdown

| Percentage | Use |

|---|---|

| 50% | Needs (housing, groceries, utilities) |

| 30% | Wants (dining out, entertainment) |

| 20% | Debt payments & savings |

Adjust As You Go

Review Monthly

Budgets aren’t set in stone. Life throws curveballs—extra expenses, pay changes, or even that birthday party you forgot about. That’s why it’s key to review your budget every month. See what worked, what didn’t, and tweak as needed.

Keep It Simple & Flexible

For tracking, I like apps or even a plain old notebook—whatever you’ll actually use regularly. The trick is consistency. One month of tracking with too many categories can feel overwhelming, so start simple. And if you hate the word “budget,” just think of it as your money plan—your family’s cheat sheet for spending smarter.

If you want some tools, you can find great free templates and trackers online—like this monthly family budget example spreadsheet can be a game changer for keeping things organized and encouraging everyone to pitch in.

Wrapping It Up

So, how to make a simple family budget? It’s really about knowing what comes in, keeping an eye on what goes out, setting a few goals that get everyone excited, and checking in regularly to stay on track. You don’t need to be perfect—the goal is progress and peace of mind.

Start small. Maybe tonight, pull out your last month’s bank statement, jot down your income and major expenses, and talk with your family about what’s important to save for. Building your budget is less like a chore, and more like a way to take back control of your money—and that feels pretty darn good.

Curious about average family spending habits? Take a peek at What is a normal family budget? to see how your numbers stack up, or dive into What is the 50/30/20 rule budget? to simplify your strategy.

Let me know—what will your first step be? Whether it’s writing down every dollar, or just agreeing on a family savings goal, it’s a win for your wallet and peace of mind.