Folks have gotten inventive about what they ask friends, family and strangers to contribute toward via crowdfunding.

One purpose rises above the rest, however, and accounts for a sizable portion of requests: paying off medical expenses.

Sadly, crowdfunding is a fairly inefficient method for tackling medical debt, according to a recent NerdWallet analysis.

Across five platforms, only 11% of campaigns aimed at medical bills were completely funded in 2015.

If you’ve never started a medical crowdfunding page but have seen many acquaintances share them on social networks, you might think, “No surprise.”

Yet if your household has been hit by unexpected medical costs and lacks the means to cover them, you may have contemplated crowdfunding. Sometimes it feels like the lone option.

Unexpected Insights About Medical Crowdfunding

NerdWallet’s research examined information from five crowdfunding services that allow medical fundraising:

- General personal fundraising platform FundRazr

- GiveForward, a site centered on raising money for others and medical causes

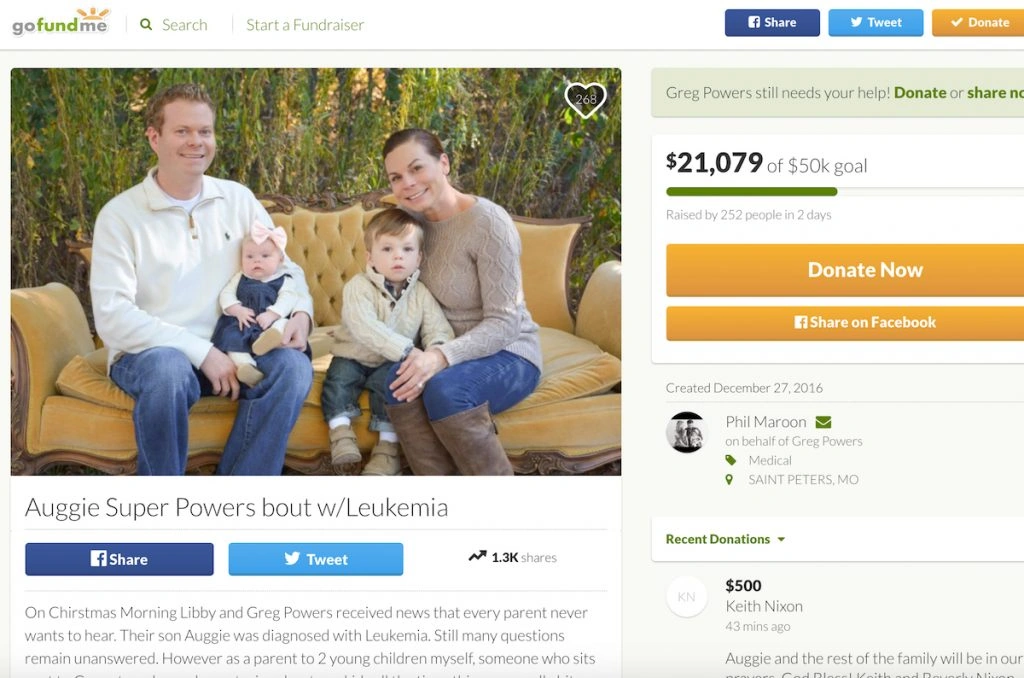

- General fundraiser GoFundMe

- Plumfund, created by the team behind Honeyfund, with an emphasis on gift-style fundraising

- Red Basket, a fee-free option for individuals and community groups

The study discovered an astonishing average: 41% of all crowdfunding campaigns on these platforms in 2015 were for medical expenses.

Consider all the quirky things people solicit funds for!

Weddings, honeymoons, creative endeavors, trips, scholarships, adopting a child, charitable projects — those (and more) combined made up the remaining 60% of campaigns. Yet medical causes eclipsed them all.

The typical target for a medical campaign in 2015 was $15,721.

Given that many Americans obtained insurance through the Affordable Care Act, why are we appealing to strangers to foot these bills?

The figure feels staggering until you unpack it.

Serious illnesses and chronic diseases are the most frequent reasons for medical crowdfunding. These conditions bring a barrage of charges for doctor appointments, expensive treatments and prescription medications.

Additionally, many campaigns request funds to offset living expenses for the patient or a caregiver, GiveForward CEO Josh Chapman told NerdWallet. Families often need help covering lost income, unusual transportation costs and childcare while dealing with illness.

GiveForward reports about 70% of medical fundraisers are related to recent cancer diagnoses.

What Helps a Medical Crowdfunding Campaign Succeed?

If you decide to launch a crowdfunding drive to address unexpected medical bills, the study offers several tips.

First, fully funded medical campaigns averaged nearly 55 donors.

Do the math: that implies contributors giving roughly $285 each on average. Those $5 and $10 donations from well-meaning Facebook contacts are useful, but you’d need a huge number of them to reach your target.

Fifty-five contributors is an attainable goal — provided you have access to that many people with a few hundred dollars to spare.

Second, most platforms levy processing fees, so factor those into your goal amount. Additionally, FundRazr, GiveForward and GoFundMe take a 5% cut of donations.

Third: It’s usually a friend or family member who starts the campaign on behalf of the patient.

“They tend to be more successful because it’s not someone asking for money for themselves,” Plumfund co-founder and CEO Sara Margulis told NerdWallet. “Something about that dynamic motivates people to give.”

Alternatives to Crowdfunding

Even with smart strategies, the odds aren’t in favor of a successful campaign. So what are your options for handling the remaining medical debt?

It may not wipe everything out, but try these approaches to reduce your medical bills.

We also consulted experts to provide practical ways to manage medical debt and steps to take if you receive an incorrect bill.

If you’re a caregiver forced to cut hours or leave work entirely, explore ways to earn income from home.

Dana Sitar (@danasitar) is a staff writer at Savinly. She’s contributed to Huffington Post, Entrepreneur.com, Writer’s Digest and beyond, weaving humor where she can (and sometimes where she probably shouldn’t).