Panic Button Moments

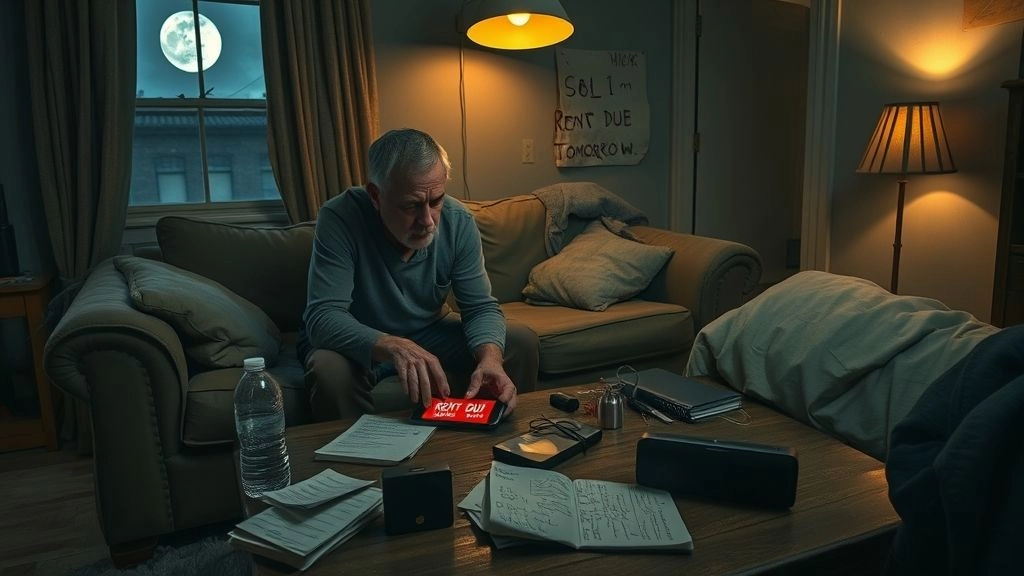

It’s 2 a.m. You’re wide awake, the red “rent due” alert buzzing in your head like a fire alarm. Ever been there? Yeah, me too. I never thought I’d be scrambling to find cash in the couch cushions, desperate for even a few dollars. But life throws curveballs—unexpected car repairs, a smaller paycheck, a bill you forgot about. Suddenly you’re searching, frantic: Need money to pay rent tomorrow—and everything feels urgent, almost surreal.

Look, if you’re panicking…you’re not alone. Seriously, SO many of us have lived this story. When I hit my “oh crap, rent’s tomorrow” moment, what helped me most was honest advice and a game plan—minus the judgment. So, let’s get real and piece together not just quick fixes, but also simple habits that can stop this fire drill from happening again. Promise, there’s hope (and maybe a side of humor) ahead. Let’s get you out of this bind—and set you up for less stress the next time the calendar sneaks up on you.

What Works Right Now?

Can You Get Cash—Today?

Okay, first things first: Let’s talk lightning-fast options. Have anything you could sell for instant cash—like a gently-loved speaker, a nice jacket, a kitchen gadget you never used? Apps like Facebook Marketplace or a quick text to friends can work wonders in a time crunch. Last year I actually hawked a fancy coffee maker my aunt gifted me. Miss the espresso, but the rent got paid. Crisis averted.

Quick Cash Sources—Which Are Fastest?

| Source | How Fast? | Downsides |

|---|---|---|

| Sell Stuff Online | Same Day if Local | Things might not sell right away |

| Gig Apps (DoorDash, Instacart, etc.) | Often Same Day | You need to get lucky with availability & tips |

| Borrow From Friends/Family | Instant if you have help | Pride…awkward convos…potential for guilt trips |

| Payday Loan / Emergency Loan | Same-Day Approval (online or storefront) | Very high interest—use only as a last resort |

Need another ace up your sleeve? Check out resources like $2,000 rent assistance—some folks I know have landed same-day or next-day help through these programs. Rental assistance options genuinely exist for emergencies like this, and you shouldn’t feel weird reaching out. It’s what they’re there for.

Should You Get a Loan?

Emergency or payday loans. They sound tempting—especially when there’s no time to wait. So, do they really work? For me, it’s always been… complicated. I grabbed one once, and, yes, it covered rent, but those fees had me eating oatmeal for a month. Still, if the alternative is eviction, sometimes you gotta do what you gotta do.

If you’re on the brink and your options are super limited, you can check legitimate emergency loan sites, but—for the love of your future self—read those terms. A lot of these loans process super fast, but if you have a steady income, you might get a better deal through a personal loan or installment loan instead of those ultra-high-interest payday deals. Need to weigh your options quickly? Take a look at I need help paying my rent before I get evicted for eviction prevention steps as well as lender details.

Payday Loan vs. Personal Loan

| Type | Speed | Interest | Best For |

|---|---|---|---|

| Payday Loan | 1–24 hours | Very High | No credit, need $ quick, all other options gone |

| Personal Loan | 1–5 days (sometimes faster) | Much lower | Decent credit score, steady income, can wait a day or two |

Help in Hiding

Government Programs? Maybe Closer Than You Think

Hold on—did you know most communities have some kind of rent-assistance program lurking in the background? Sometimes it’s called the rent bank, emergency housing fund, or “hardship grant.” Sounds old school, but it’s real. Cities like Toronto have programs that give out grants—sometimes up to $2,000—to help cover rent for folks who qualify. You might not even have to repay it. Not just in big cities, either. Even smaller towns often have something similar if you start digging.

The process can be a little…clunky. But if you explain to a caseworker, “Listen, need money to pay rent tomorrow, what do I do?”—sometimes you’ll be amazed at how fast things get moving. Try calling 211 or checking websites like your city’s services page. Friends of mine have gotten emergency help within a single day when the clock was really ticking. More about these things at Need help paying rent ASAP, especially if eviction is on the table.

Community Nonprofits and Unexpected Lifelines

I always thought rent help came only from the government or banks. But there are these incredible local nonprofits—like the Salvation Army, United Way, Catholic Charities, or even those “modest needs” grants—that might spot you the cash you need. Some offer grants, not loans. Others have hands-on programs that kick in when you walk in and explain your deal in person.

Got a minute? Dial 211 or Google “emergency rent assistance + your city.” It’s old-school. It’s awkward sometimes. But people do care, and they have real money for situations just like yours. And if things are looking truly grim, tapping into crowdfunding is an option. I know, “asking strangers for money” sounds bananas, but I’ve seen GoFundMe save families on the edge. Your story matters, and people get it.

Comparing Your Help Options: Local vs. National

| Program | Eligibility | Amount | Speed |

|---|---|---|---|

| City/Government Grant | Proof of hardship, low income | Up to $2,000 | 1-10 days (sometimes faster if urgent) |

| Local Nonprofit | Anyone—prioritize urgent need | Varies (often $500–$1,000) | 1–3 days |

| GoFundMe or Crowdfunding | No formal requirements | Whatever you raise | Depends—hours to days |

Heard of a neighbor running a GoFundMe last winter when both their jobs dried up overnight? They raised just enough to keep their apartment and get through the rough patch. There’s zero shame in asking when you truly need it.

Your Landlord Is Human Too

Ever Tried Just… Asking?

Not gonna lie, this was the move I was most scared to try. But years ago, after a random hospital bill wiped out my buffer, I called my landlord and just told him what was up. I said, “Look, I’ve always paid on time, but this surprise bill hit me hard—can we move my due date back a week?” He actually thanked me for the honesty and gave me a one-time grace period. Not all landlords are monsters. Sometimes they’d rather keep you happy than go through the mess of finding a new renter.

So even if it’s awkward, try it. Be honest. Lay out what you can pay and when. Propose a specific new due date and, if possible, give some partial payment up front. Landlords appreciate communication over ghosting, trust me.

What Should You Say? Here’s a Quick Script:

“Hi, I know rent’s due, but I’ve hit a real snag right before payday. I’m doing everything I can (side gigs, borrowing, applying for help), but I’ll be short this time. If you could give me until [date you expect funds], I can pay you everything — or at least part now and the rest by then. Is that okay?”

Last-Ditch Hustles

Can You Make Money Today?

Not all heroes wear capes. Some wear DoorDash visors, hunched over steering wheels delivering takeout. Gig economy jobs have a lot of flaws…but if you need money to pay rent tomorrow, you can grab your keys and start earning before breakfast. Seriously—friends have paid half their rent on a long Saturday just delivering groceries or moving couches for cash. Some apps even offer instant cash outs these days (for a small fee, but hey, rent is rent).

No gig apps near you? Hang flyers, ask neighbors—dog walking, babysitting, moving boxes, whatever works. It’s fast, it’s not forever, and with luck (and hustle, and probably some sweat), you can make a rent dent by sundown.

Which Hustles Pay Quickest?

| Gig | Potential Earnings (Daily) | Pay Speed |

|---|---|---|

| Food Delivery (Uber Eats, DoorDash) | $50–$150 | Same day (if instant cash out) |

| Dog Walking/Babysitting | $20–$100 | Cash, sometimes Venmo/PayPal |

| Sell Stuff (Online or Yard Sale) | $30–$300+ | Cash, PayPal—all at once if local |

If all else fails, remember you can always check I need help paying my rent before I get evicted online for last-minute tips. It gives you real, sometimes oddball ideas you might not have thought of. (I once mowed lawns for $25/hour! Who knew?)

Small Tweaks That Save Big

Frugal Habits—The (Unsexy) Secret Weapon

Have you ever noticed how the most boring money advice—like “track your spending” and “cook at home”—actually works best when life gets unpredictable? I used to hate budgeting. Who wants to face scary numbers after a long day? But when I finally started writing down every dollar spent, even if it made me cringe…magic started happening. Turns out, there was an extra $100 a month hiding in late-night snacks, vending machine sodas, streaming subscriptions. Budgeting doesn’t have to be rules and no fun—it can actually set you free.

Right now, maybe you’re thinking, “Sure, but what about today?” Fair question. But these small switches add up for next month—and the month after. Little stuff, like eating leftovers, batching errands, or even freezing bagels so they don’t go bad (and you don’t have to buy breakfast out)…honestly, it stacks up. Frugality is just getting the most out of every bit you already have. My freezer is packed with sale meats, and my go-to lunch is whatever I find in my pantry. Pioneer spirit—use it up, wear it out, make it do, or do without (see these old-school frugal tips) still rings true.

Sample Before-After Budget Tweak Table

| Expense | Old Monthly Cost | After a Frugal Tweak | Savings |

|---|---|---|---|

| Coffee Shop Runs | $50 | $8 (homemade coffee) | $42 |

| Streaming Subs | $40 | $8 (cut to one pop-up month) | $32 |

| Dining Out | $150 | $50 (once a week max) | $100 |

| Total Monthly Savings | $240 | $66 | $174 |

That’s almost half a rent payment without even trying that hard.

Emergency Funds You Can Actually Build

When I first heard “save three months’ rent,” I laughed out loud. I was barely making one month at a time! But seriously, even $10 or $20 a week stacked in a jar (or a separate account you don’t touch) is enough to keep the wolf from the door. There were nights I scrounged and rolled coins just so I didn’t have to swipe a card for rent. Embarrassing? At the time. But now, it makes me proud. You start small, with coins or whatever you can spare. Appreciate every single win.

Got room to do more? Try splitting your rent across debit and credit cards using an app, the way Kasheesh suggests. It’s not a glamorous trick, but if your landlord takes these types of payments, this approach can buy you an extra week to pull things together. Sometimes, scrappy is better than perfect.

Still need help? Dig through Need help paying rent ASAP options to see if there’s something you missed—grants, gig ideas, or even creative swaps in the frugal community.

Final Thoughts—You’ve Got This

If you’re stuck in a swirly-cloud panic because you need money to pay rent tomorrow, don’t lose hope. I’ve been down to the wire, embarrassed, and even a bit defeated. You’re not alone—and you’re not a failure. Sometimes, life wallops you, and all you can do is patch things together, dollar by dollar, honest conversation by honest conversation. But that’s okay: small wins add up.

Let yourself feel whatever you’re feeling. Then act. Get scrappy. Sell what you don’t need, gig for cash, reach out for help (seriously—there is no shame). Make those calls, send that awkward text, apply for that assistance. Side step by side step, you’re solving the problem. And by finding little frugal hacks—like tweaking your food spending, tracking what you buy, or leaning on a community of folks who know how you feel—you’re building something bigger: resilience for the future.

Right now, take one step. Could be applying for $2,000 rent assistance, reaching out to a neighbor, or picking up a side gig. Drop a comment—what’s worked for you? What’s your weirdest rent survival story? I’d love to cheer you on. Because hey, one frugal friend to another: you can do this. Let’s keep building that freedom—one (sometimes messy) month at a time.