Tiny Changes, Huge Impact

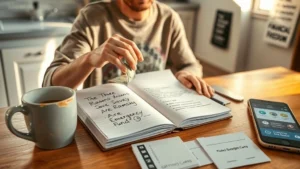

What if I told you the fastest way to save for a house isn’t about living on instant noodles (blech) or banishing yourself from all fun forever? It’s about noticing—really noticing—the tiny things you spend on each day. I’ll never forget the moment I added up all my convenience store “treat yo’self” snacks for a month… Let’s just say my jaw dropped harder than the time I tried yoga. That kind of realization? Big deal. Because every little choice adds up when you’re eyeing that front door and dreaming of your own space.

Here’s the fun part: grab yourself a how to save money for a house fast calculator (those things are like cheat codes for adults). It crunches your numbers, spits out the truth, and suddenly you’re not “hoping” to buy a home…you’re seeing exactly when it could happen. We’ll talk about where to find these calculators in a sec—and how to make them your new BFF.

Why Calculators Are Magic

Ever Wonder Where Your Money Goes?

Seriously, isn’t it wild how your paycheck can feel hefty one moment and then the next… poof… it’s gone? Back in my early twenties, I couldn’t figure out why my savings account was always so anemic. Then I got curious—like, let’s-lift-up-the-couch-cushions curious—and used a savings calculator. (If you want specifics, tools like Ramsey Solutions’ mortgage payoff calculator or MortgageCalculator.org’s down payment goal one do the trick.)

Enter some numbers: your goal amount, monthly income, what you’re stashing away right now. (Don’t lie. You can’t trick the calculator.) Then? Tweak stuff. Even a little bit extra each month—like, sacrificing a couple takeout meals? The calculator shows how you can knock literal years off your savings timeline. I know, math is usually a party killer, but this is math that says “YES, you might move sooner than you think.”

Making Extra Payments: the Low-Key Power Move

Just as an example… let’s say you’re able to toss an extra $300 into savings every month. Tools like Ramsey’s calculator show that this could help you pay off your home 11 years faster and save over $64,000 in interest if you’re carrying a $200,000 mortgage. Even if you’re not there yet, just seeing what could happen? Motivates me like nothing else.

| Scenario | Monthly Extra | Years Saved | Interest Saved |

|---|---|---|---|

| Standard Payments | $0 | 0 (Full 30-Year) | $0 |

| Small Boost | $300 | 11 Years | $64,000+ |

| Big Push | $1,000 | 16 Years | $156,000+ |

Try dropping a story here from your own life or someone you know. Like my friend Sam, who set up automated savings—he forgot about it until his birthday, checked, and nearly fainted when he had enough for a starter place deposit.

Budget Leaks: Find Yours

Where’s the Money Really Going?

Okay, confession: I used to lose SO much to random “treats” and those baby subscriptions that sneak onto your bank statement. Have you ever noticed how sneaky small purchases can be? It’s like the money’s playing hide and seek, but always wins. Here’s where the how to save money for a house fast calculator becomes almost…fun.

Take one of those down payment calculators—like the one on MortgageCalculator.org. Input your income, projected house price, and savings goal. Then, pause. Audit the heck out of your budget for a week. (I know it sounds boring, but I started texting myself every time I spent on something silly, and now my friends think I’m hilarious. “$2.18—late-night gas station cookies. Regret: 4/10.”) Now, put that newly “freed up” $100, $200, or even $50/mo into the calculator and watch that timeline — seriously, months start disappearing. It’s kind of addicting…in a healthy way?

Stories from the Frugal Trenches

If you want more proof that this works even on a tight budget, check out how to save money for a house on a low income. There are real stories of folks who made small swaps—like meal prepping instead of buying lunch—and saw the numbers change faster than you’d believe.

Location Tricks: Why Where You Live Changes Everything

Exploring Neighborhoods Pays Off

You know how some people save for a decade, and others seem to make it work in a couple of years? So much comes down to location—both where you’re saving and where you’ll eventually buy. If you’re hunting for how to save money for a house fast near ho chi minh city or a major hub, you’re not alone…everyone wants a slice of somewhere lively. Guess what? There are all sorts of hacks. Maybe you get a roommate for a while, or try a place a bit farther out. (I once “temporarily” lived an hour outside my city for cheaper rent, saved a chunk, then moved back in closer once the deposit was sorted. Worth it.)

And if you’re zoning in on neighborhoods like District 7, there’s a whole playbook for how to save money for a house fast near district 7. Seriously, people overlook how much you can save just by switching districts, even for a year or two. Lower rent, cheaper utilities…those differences add up to real money for your house fund.

District vs. City: Compare the Numbers

| Area | Typical Rent Deal | Monthly Savings Potential |

|---|---|---|

| District 7 | Negotiate utilities or find roommates | $200-$400 |

| Ho Chi Minh City (central) | Shift farther out temporarily | $300-$600 |

Add those savings into your trusty how to save money for a house fast calculator and … mind blown. Some of my friends even rotated between districts to rack up savings goals in turbo mode. Was it glamorous? Nope. Did it work? 100%.

Bad Credit? No Judgment—Just Solutions

What If Your Score Sucks?

Look, most of us aren’t born with a perfect credit score. (If you are, I need you to buy me a lottery ticket.) For the rest of us? It just means a little more hustle, a little more planning. The key: knowing how improving your credit shifts the numbers in your favor. Mess around with a mortgage calculator—Bankrate has a good one—and watch the monthly payment possibilities change if you give your score a boost. Suddenly, what seemed impossible starts looking kinda reasonable.

You might find this post helpful: How to save money for a house fast with bad credit. It’s packed with ways people improved their rates, got better terms, or even landed special programs for “not-so-perfect” credit folks. Real talk: I watched my next-door neighbor chip away one card at a time for six months. He ended up scoring a lower rate and saved thousands over the life of his loan. It’s doable. Even small changes make a dent when you track them in a calculator. Try it—it’s almost…satisfying?

Before & After: Score Adjustment Pays Off

Let’s break it down. A lower interest rate (thanks to a score bump) can mean saving tens of thousands over the life of your mortgage. That’s money you’d rather spend on cool lamps or, I don’t know… pizza parties in your new place.

Side Hustle? Heck Yes!

Turning Spare Time Into Extra Cash

You probably saw this coming, but there’s just no way around it: sometimes, you have to make the pie bigger, not just cut smaller slices. If picking up a few extra hours feels like a drag, just use a savings calculator to see what the effort could really mean. Suddenly, that Saturday gig doesn’t sound so bad. Banner Bank’s home buyer calculator is great for this—plug in even $200/month extra, and see how your timeline drops from four years down to…what? Two and a half?

There’s a local flavor to this, too. If you’re based around District 7, check out how to save money for a house fast near district 7 for real stories of folks flipping skills into down payment wins. Kind of inspiring, actually. Like my cousin, who used to dog-walk mornings before his 9-to-5—stacked an extra $150/month and bragged about “paw-sitive cash flow” at family dinners.

| Side Hustle | Weekly Hours | Potential Monthly |

|---|---|---|

| Delivery Apps | 6–10 | $300–$400 |

| Freelance Tutoring | 4–8 | $200–$600 |

| Crafts/Market Stalls | weekends | $200–$800 |

Point is… you don’t have to work seven days a week or sell your soul. But even a few hours here and there, if the money goes straight into a dedicated house account (bonus points for making it less tempting to touch), it really stacks up. Your how to save money for a house fast calculator will show you—visually, like a hype-man cheering you on—just how motivating those little wins can be.

Reflection: Now or Never?

What’s Holding You Back?

Be honest—what’s stopped you from saving before? For me, it was always thinking it was “someday” money, not “this year” money. But as soon as I started using calculators, tracking actual numbers, and seeing my savings timeline shrink in real-time—it felt possible. Game-changing, even. I still splurge here and there (life’s too short for zero lattes), but now I’m confident I’m moving closer to my goal. Each new calculator run is like a high score on an arcade machine…just less noisy and more adult-y.

And remember, you’re not alone in this. There are countless people in your shoes, running the same math, confronting the same doubts, surprised by the same big and little wins. Whether you’re chasing down tips for how to save money for a house fast near ho chi minh city, hunting advice for building credit, or just want simple, low-income hacks—there’s room for everyone on this journey.

Ready? Go Make That First Move!

Okay, let’s be real. No one’s pretending saving for a house is easy. But it’s sooo much less overwhelming when you slice it up into manageable little bits—and see how far a single tweak can go. Grabbing a how to save money for a house fast calculator is honestly the best way to turn “maybe one day” into “wow, look how close I am!” Slim down spending, pick up a little extra, get creative with your location… heck, just tighten your budget one coffee at a time. Each move matters.

My advice? Try out one or two ideas from here—maybe just the budget check or checking out side gigs. Plug your new numbers in, watch that finish line slide closer, and celebrate every inch of progress. After all, your story gets to begin right at the moment you decide to shift from “what if” to “watch me.”

I’ll be cheering from the sidelines… and probably running the numbers on my own savings, because let’s face it, those calculators are kind of addictive. What’s the one small change you’re going to try out first? Hit reply, share your best tip, or—even better—shout when you hit your goal. Who knows, maybe you’ll inspire the next person to start their journey today.