Wait, Did You Feel That?

Ever have that subtle panic when payday’s still a week away and your checking account looks…well…a little sad? Maybe you bought a few more “treat yourself” coffees (worth it?) or skipped checking your bank app because, honestly, ignorance felt like bliss for one more day. We’ve all been stuck in that financial twilight zone—heart thumping a bit when your card gets swiped at the grocery store, half-praying it goes through.

I used to brush off that feeling. “Oh, I’ll just budget better next month.” Except, uh, a decade zipped by and “next month” never came. The real kicker? School never taught most of us the basics—actual money management rules that work in normal, messy lives. So, let’s get real about frugality, saving money, and those tiny tweaks that turn stress into breathing room. And maybe a little peace of mind.

Things Nobody Taught Us

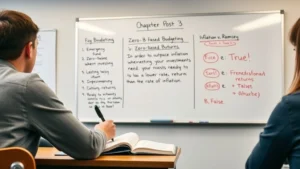

What Did School Even Teach Us About Money?

Let’s play a game. Think back: Did your high school teach you how to understand your credit score? Or, say, how much to keep in an emergency fund? If your answer is “Nope,” you’re in good company.

One of my closest friends thought her credit didn’t matter until she snapped up a new car and got stuck with a cringe-worthy loan rate. (Spoiler: the monthly payment was a wake-up slap.) That’s why I always peek at my credit report in early spring. Half the time, I’m staring at numbers and codes that mean nothing…but when something looks off, at least I can fix it before it costs me.

Spend Less, Earn More

Where’s Your Money — No, Really?

Here’s the most basic, un-fancy of all money management rules: spend less than you earn. Rocket science, right? But think about your last few bank statements—can you spot a pattern?

For me, it was daily take-out lunches. That $12 combo meal adds up. Try this out: just a morning coffee run versus home-brew savings for a month:

| Coffee Shop Daily | Home Brew | |

|---|---|---|

| Monthly Cost | $90 | $15 |

| Yearly Cost | $1,080 | $180 |

Wild, right? And if you need more practical ideas, honestly, Top 10 brilliant money saving tips is a great rabbit hole. Sometimes it’s the small changes, not radical transformations, that stick.

Pay Yourself First

If You Wait, Will You Ever Save?

This rule is almost magic—and the only way I started real savings. Pay yourself first. Treat savings like a bill; automate it so money leaves your checking right after payday. Out of sight, out of spend-happy mind.

I started with 10%. Honestly, I snorted when I read those “save 20%” guides online. But 10% went unnoticed, mostly. And about six months in, I checked my balance and was like, “Where did this money come from?!” It works. Automating is my grown-up superpower.

If you’re in college or just figuring out your flow, scoop up some Money management tips for students too—I wish I’d had this stuff when cafeteria pizza was my biggest life expense.

Emergency Cushion: Not Optional

How Much Is “Enough”?

Here’s a rule you’ll thank yourself for even if it’s boring: 3-6 months of basic living expenses in a stash fund. Sounds huge, but even scraping together $500-$1,000 is a gigantic mental shift. One winter, my ancient sedan finally waved the white flag (on the coldest morning ever, obviously). No budget. Credit card to the rescue…except then the next month slammed me with interest.

Just having a little emergency stash now lets me sleep at night. Bonus: my plants don’t judge my financial choices. Build it a little at a time—skip one delivery meal and throw $10 into savings. Rinse and repeat.

50/30/20: The Lazy Genius Budget

How Do You Even Budget Without Losing Your Mind?

Some folks dig spreadsheets. Me? My brain glazes over. But then the 50/30/20 rule clicked:

- 50% to needs (rent, bills, actual groceries)

- 30% to wants (yup, fun stuff)

- 20% to savings

Let’s say you bring home $4,000/month:

| Category | Amount |

|---|---|

| Needs (50%) | $2,000 |

| Wants (30%) | $1,200 |

| Savings (20%) | $800 |

It’s not perfection—more like ballpark guidance that keeps you trending in the right direction. Overwhelmed already? Grab some Free money management tips for beginners and just start anywhere. No shame in baby steps.

Beware Lifestyle Creep

Is Your Raise Actually Helping You?

Got a raise? Heck yes! But wait—did your spending just expand to match? (Been there.) That’s “lifestyle creep.” My friend used her first big bonus to upgrade dinners out, when just a couple months earlier, pizza night at home was “fancy.” Two years later, she realized she’d saved less than before her raise. Oops.

The rule: try to stash more instead of matching every increase in income with new expenses. One treat is cool, but letting your budget explode? Not so much.

Credit Scores: Your Silent Frenemy

Are You Checking Yours?

Let’s face it, credit scores are mysterious numbers that can either save you a pile or cost you (see: my car note mess). Step one? Actually check your credit report—once a year, at least. Look for errors, weird accounts, or identity theft. Fixing mistakes can bump your score pretty fast.

The game-changer: I once snagged a lower insurance premium just for asking about my credit score. Who knew? (Not me, at 23…)

Bad Debt? Tackle It Head-On

Make Your Payoff Plan—Not Just The Minimum

That “minimum due” box on your statement? It’s the credit card company’s best friend, not yours. If you’re facing credit card debt, two classic ways out are the snowball and avalanche methods. Break it down?

| Method | How It Works | Mental Boost |

|---|---|---|

| Snowball | Pay off smallest balance first | Quick wins keep you motivated |

| Avalanche | Pay off highest interest first | Save more on interest over time |

Honestly, pick whichever keeps you going. Momentum matters more than math here—or, start with snowball and later switch to avalanche.

Invest Even If It’s Small

Seriously… Is $50 Enough?

If you think you need thousands to start, let’s debunk that myth right here. Compound interest loves early birds. Example time: putting aside just $50 a week at a 6% annual return? That’s roughly $63,000 after 15 years. (Math courtesy of one of my favorite money podcasts and a calculator when I triple-checked because I was sure it was a typo.)

If you’re still studying or just learning, don’t miss these Money management tips for students—applicable even if you’re “adulting” well past graduation.

Budget For Life’s Plot Twists

What’s Your Weirdest Financial Emergency?

Honestly, life is like that “plot twist” meme—right when you think you’ve got it, surprise! I tried to budget for a normal month once and my dog promptly swallowed my headphones. Hello, emergency vet bill.

Budgeting for surprises is another overlooked gem in the money management rules toolkit. Even $10 or $20 tucked into a “miscellaneous” envelope here and there helps. (Also, insurance: not exciting, but a pain-saver in a pinch.)

Pssst—Generosity Matters Too

Giving Isn’t Just For The Wealthy

This one’s unexpected, but stick with me: including a bit for giving (even if it’s a coffee for a friend or donating old clothes) somehow made me feel richer, not poorer. It resets my “enough” button, you know?

Charity doesn’t have to be cash—it could be time, leftovers, or even advice. Simply leaving room in your budget for others keeps money from running the show.

So, What’s Your Move?

Okay, exhale! That was a lot of rules, stories, and tables. But here’s the real talk: money management rules aren’t meant to box you in or spark shame. They’re like training wheels. The more you ride, the easier it feels—until one day, you’re cruising without white-knuckling the handlebars.

You don’t have to implement every tip overnight. Maybe you automate your savings, or you check your credit for the first time this year. Maybe you swap that $5 latte for homebrew Mondays, build your emergency fund, or explore those Free money management tips for beginners when you have a spare minute.

One little step is all it takes. You’ll start catching your own financial stress “alarm bells” with way less panic—and more confidence. What’s your first move? I’m all ears—drop a comment, share a mini-win, or just promise yourself you’ll check in on your spending tonight. You’ve got this…really. And I’m rooting for you every step of the way.