Where Does All the Money Go?

Most people don’t realize you can save hundreds—yep, hundreds—every single month just by flipping a few daily habits. Sounds dramatic? Sure. But it’s true. Let’s be honest, managing your money can feel a bit like chasing a squirrel in a crowded park—darting here and there, attention everywhere, and still, poof, your paycheck disappears. Ever wondered where all your money goes? I have. More times than I’d like to admit, actually.

Here’s the thing: you don’t need high-level math or a bunch of fancy spreadsheets to get started. Just a smidge of curiosity and maybe, for now, a willingness to peek at your bank statement without flinching. (I used to avoid mine like a haunted house. Spoiler: it never helped.) These free money management tips for beginners are exactly what I wish I’d known when I was scraping by and feeling lost. Ready?

The Weird Magic of Tracking

Seriously, Where’s Your Money Going?

Forget about setting up a “perfect” budget first. Just track your spending for a week. Truly. Write down every dime. That $6 cold brew? The last-second snacks? The tiny “harmless” digital subscriptions? They add up quick—like, mini-avalanche quick.

When I first tried this, I realized I was spending more on streaming services and spontaneous gas station snacks than on actual groceries. Oops. No shame—lots of people are right there with you. (You’re in good company, I promise.) If you want to get fancy, try a budget app or just use your phone’s Notes app. The goal? See your habits in the light of day. Trust me, you’ll spot some surprises… good and bad.

The Before-and-After Table

| Week 1: No Tracking | Week 2: Tracking | |

|---|---|---|

| Groceries | $120 | $95 |

| Takeout | $45 | $18 |

| “Small” online buys | $50 | $15 |

Wild, right? Most people waste more than they realize—just like I did. For more hands-on advice, especially if you’re juggling classes and side gigs, these money management tips for students are a lifesaver.

Be Honest: Needs or “I Just Want It”s?

What’s a “need”? Food. A roof. Health stuff. “Want”? That third burrito this week. Or the shiny sneakers calling your name online. When you track things for a while, the pattern emerges—sometimes painfully. But here’s the magic: once you see what’s “leaking” out, you can patch it.

Try this: next Saturday, look over your week and highlight every “I really didn’t need that” with a silly emoji. How much could you have saved? (I once found I blew $23 on vending machine snacks. In a week.)

Setting Money Goals That Don’t Suck

Dream Big. Start Tiny.

Goals usually feel huge and kinda scary, don’t they? “Save $5,000.” “Pay off all my debt.” Feels impossible. Instead, pick a goal you can hit in a month—like “I’ll save $50 towards a rainy-day fund” or “I want to cut my takeout spending by a third.”

The trick? Tie goals to stuff you actually care about. Hate feeling stressed when the rent’s due? Make an emergency fund. Want a fun trip someday? Name your savings jar “Best Beach Ever.” (I literally label my jars. It feels silly but makes me smile when I toss in a five.)

Not sure where to start? For beginners, using “SMART” goals helps—keep it Specific, Measurable, Achievable, Relevant, and Timely. (Yeah, there’s a whole set of top 10 brilliant money saving tips over here. Seriously practical stuff.)

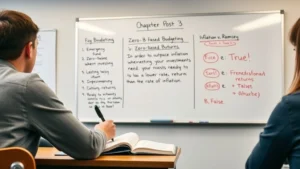

How to Actually “Budget”—Without Losing Your Mind

Budgeting has a bad rap. Maybe you picture endless spreadsheets or some vibe-killing ban on fun things…but stick with me. There’s no “right” way to do it. Think of your budget like a map—just showing you where you are, and how to not get lost. Want a super-simple version?

Budget Showdown: 50/30/20 vs. Zero-Based

| Method | Why It’s Easy | Who Should Try? |

|---|---|---|

| 50/30/20 | Half for needs, 30% wants, 20% savings/debt | First-timers, folks who want flexible rules |

| Zero-Based | Every dollar has a “job” each month | Detail-lovers, or if you tend to overspend |

I love zero-based (eventually)—it helped me realize I was underestimating monthly expenses by a mile. But when in doubt, just pick one. And please remember, your budget’s not carved in stone. Life changes. So does your money map.

Automate the Boring Stuff

Making It Foolproof (Even On Tired Days)

My brain forgets stuff… often. That’s why automating parts of my money life was a huge win (and a big money-saver, because, um, late fees are truly the worst). Odds are, your bank will let you set up an auto transfer—just 5% or 10%—straight into savings. Do it on payday if you can. That way, the money “disappears” into your savings before you can spend it.

Another tip? Set up bills for auto-pay if possible. Less stress, less last-minute panic. The days I started using direct deposit, I felt so much less… scattered. I worried less about “did my check clear?” and more about: “Do I want ramen or tacos tonight?” (True story, both are cheap and delicious, but only one leaves spare change for savings!)

Building Your “Just in Case” Fund

Car breakdowns. Sudden vet bills. A broke phone. That’s life, right? If you can start putting even a tiny amount aside, you’re already ahead. Even $200 in an “uh-oh” fund makes the world feel 1000% safer. (I once had to shell out for a surprise dental bill, and thanks to my stash, I didn’t freak out—well, not about the money, at least.)

If you want more ways to build up an emergency fund without eating only instant noodles, peek at these top 10 brilliant money saving tips. No stress—just ideas.

Simple Money Management Rules

What Are Money Management Rules Anyway?

If you ask five finance “gurus” for the best money management rules, you’ll get ten different lists. So here’s what actually works for regular, overwhelmed people (like me and maybe you):

- Spend less than you make. Obvious, not always easy.

- Save something, no matter how small. Every. Single. Month.

- Pay bills on time. Set reminders if you have to—late fees bite.

- If you use a credit card, pay it in full every month if humanly possible.

- Automate anything you can. The less you have to remember, the better.

- Plan for “uh-oh” stuff—small emergencies WILL happen. If they don’t? Awesome. More in your pocket.

If you need to see these in an even clearer “what-do-I-do-next” way, grab the free money management tips for students. (Yes, they work even if you haven’t seen a lecture hall in years.)

Debt: Ugh. But Also, Not Unbeatable.

Okay, let’s talk about it. Debt stinks. But ignoring it? That’s way stinkier. If you’ve got a bunch of mini debts, stack ’em up and tackle the smallest one first. It’s the “snowball” method (and it really works, because knocking out that first one feels amazing). Or, for lower interest, try the “avalanche” method—pay highest interest first.

Whatever method, keep moving forward. I celebrated every paid-off credit card with a tiny “treat yo’self” splurge (like an ice cream sundae, not a shopping spree).

For those who feel lost in all the options, the people over at money management tips for students break it down with tips you actually want to use.

Get a Little Sneaky With Saving

Save Early. Save Weirdly Often.

Here’s one of my favorite free money management tips for beginners that sounds too obvious but is somehow…hard? Start saving before you feel “ready.” Even $5 a week—stick a reminder in your phone—can turn into $250+ for holiday gifts, birthday parties, or emergency pizza nights. Compound interest is your friend here: the more often you save, the less you’ll feel it, and the faster it grows. Start early. Start small. Just…start.

And hey, speaking of sneaky strategies, don’t let those workplace or student perks go unnoticed. Check your job benefits for free money opportunities—401(k) matching, tuition help, wellness reimbursements. That’s savvy. Sometimes, it’s actually “finding” free money on the table. For more, check out free money management tips for students for other overlooked tricks and deals.

Microsaving: Small Wins That Add Up

You don’t need apps that round up every purchase to save (though that’s cool, too). Try stashing your change, selling unused clothes, or doing a mini “no spend” week: eat what’s in the fridge, skip new buys, and see how creative you can get. Once, I saved over $70 in one month by doing nothing fancier than making coffee at home and swapping to the generic brand at the store. (Tasted 90% as good, kept 100% more dollars in my account.)

Refreshing Your Plan (And Keeping It Real)

Check In—Don’t Stress Out

Your budget is not a diet. Please, don’t beat yourself up if things blow up some months—flat tires, birthdays, long stretches between paychecks… life happens. Try to peek at your spending every month or so. Adjust, reset, forgive, repeat. Progress, not perfection, is the whole idea. Nobody gets it “right” every single month. (Anyone who says otherwise is probably just not talking about it.)

If you want to see all these tips in one cozy space, and maybe get a little nudge for next week, visit top 10 brilliant money saving tips. There’s always a new angle to try.

The Last Word: You’ve Got This!

Look, you don’t need to overhaul your whole life to start feeling better about your money. Tracking your daily grab-and-go snacks, picking a budgeting style, creating fun names for your savings jars—these are real wins. Small moves, real impact. My first emergency fund? It was $180. Not exactly epic, but it sure changed how I slept at night.

Try one tip from this list right now. Tomorrow, try another. Because the truth is, these free money management tips for beginners work for anyone who’s ready to start—even if “ready” just means a tiny bit curious. If you’re ever stuck, dive back into the top 10 brilliant money saving tips or collect more honest truth from the free money management tips for students.

Your financial future really is built in these small moments: taking notes on a receipt, skipping a “want” now and then, building up your “just in case” fund. No shame, no rules police—just a little bit more freedom, every day. So, what’s your first small step going to be? Hit me up in the comments. Let’s make saving money just a little less lonely, together.