Let’s be real — managing money as a student can feel like juggling flaming torches while riding a unicycle. Between classes, friends, and the odd impulse buy (hello, late-night pizza), it’s easy to lose track of where your money goes. But what if I told you that with just a few simple habits, you could actually get ahead and even save up for the fun things you want — without stressing about your bank account all the time? That’s exactly what I want to share with you today: some down-to-earth, practical money management tips for students that fit your busy life.

Whether you’re still in high school figuring out your finances or deep into college and already facing those dreaded bills, these tips will feel like a friendly nudge from someone who’s been there. Ready? Let’s dive in.

Know Your Flow

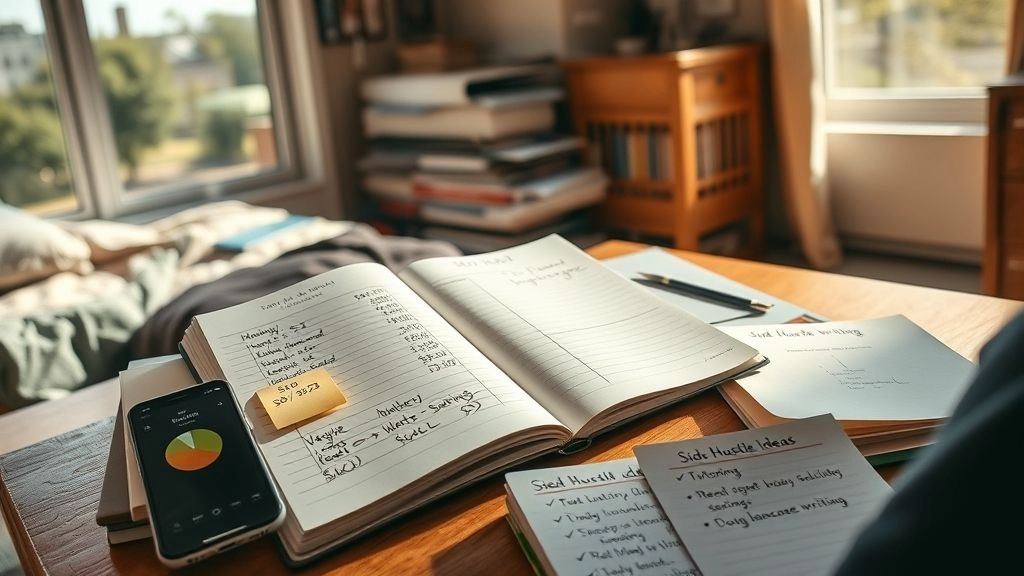

Ever finish a weekend wondering, “Where did all my money go?!” Yep, been there. The first step to taking control is understanding exactly what’s coming in and what’s going out — no judgment, just the facts.

Why Track Every Penny?

Tracking your expenses might sound tedious, but it’s like shining a flashlight into a dark room where money leaks hide. You’ll spot those little expenses, like $4 coffee runs or spontaneous online shopping, that quietly add up.

You can do this old-school with a notebook or grab one of the many free apps out there like Mint or PocketGuard (or even start with a simple Money management tips for high school students guide to get comfy with the basics). The key is honesty — and consistency.

Example: Expense Tracking Table

| Day | What I Spent | Category | Total So Far |

|---|---|---|---|

| Monday | $5 coffee | Food | $5 |

| Tuesday | $20 books | School | $25 |

It’s kinda like detective work — but for your wallet. Once you spot the patterns, you can take action where it counts.

Budget Without the Boredom

Ah, budgeting — the word alone might make you yawn. But hear me out: it’s not about restriction; it’s about freedom. Freedom from money stress, from last-minute scrambles, and from wondering if you can swing that new hoodie.

What’s the Easiest Way to Start?

Begin with the classic 50/30/20 approach but feel free to tweak it for your student life. Think: 50% for needs (rent, groceries, bills), 30% for wants (those nights out, hobbies), and 20% for savings or paying down debts. The magic happens when you actually write it down.

Pro tip: don’t make your budget a straitjacket. Life happens, and flexibility is your friend. Review your budget weekly or monthly — a quick check-in keeps you honest without feeling suffocated.

Struggling to figure out where to begin? The Money management tips for college students have some neat tricks around prioritizing spending that might spark ideas.

Real-Life Tweak

One friend of mine swapped dining hall meals for home-cooked dishes a few nights a week — saved $200 a month and still had time for weekends out with friends. It’s all about shifting your choices without feeling like you’re missing out.

Cook, Don’t Just Eat Out

If you ask me, the single best money saver for students is learning to cook. Don’t roll your eyes — even simple things like pasta, scrambled eggs, or a veggie stir-fry can be total game changers.

Can Simple Meals Save Big Bucks?

Absolutely. Imagine spending $10 on groceries that cover you for several meals, rather than $10 per meal ordering out. Over a month, you’re talking serious savings — enough to buy those concert tickets or put toward a new gadget.

| Meal Idea | Cost | Takeout Equivalent |

|---|---|---|

| Veggie Stir-Fry | $3 | $15 delivery |

| Bean Tacos | $2 | $12 fast food |

And hey, cooking can be fun! Think of it as a little break from studying — plus, you can impress friends (or roommates) with your skills.

For more ways to cut costs around campus life without feeling like you’re pinching pennies, don’t miss 25 financial tips for college students — they’re packed with realistic ideas.

Side Hustles That Fit

Okay, so sometimes the budget just doesn’t stretch. That’s when side gigs come in clutch. But the trick is to find ones that won’t wreck your grades or your sanity.

Which Side Jobs Work Best?

Think: tutoring someone in a subject you love, freelance writing (if you like typing), or even dog walking around campus. These can bring in extra cash without demanding full-time hours. And hey, they look great on resumes too.

Quick Pros & Cons

| Job | Pros | Cons |

|---|---|---|

| Tutoring | Steady hours, subject mastery | Limited evening slots |

| Delivery | Flexible schedule, quick cash | Gas and wear on vehicle |

One buddy of mine started dog-walking during finals — earned about $300 extra that month and it was a nice stress-break too. It’s all about balance. And as you get older, these gigs gently lead into Money management tips for young adults and bigger financial responsibilities.

Credit Cards: Friend or Foe?

Credit cards get a bad rap, especially with scary stories about debt. But, when handled right, a credit card isn’t your enemy — it’s actually a tool. The key? Responsible use.

How to Stay Out of Trouble?

Always pay your bills on time. It’s better to pay the whole balance than a minimum, so you avoid crazy interest. And never max out your card — keeping your credit utilization below 30% helps build a strong credit score, which you’ll need down the line for car loans or rentals.

Rewards and cashback are nice perks too — just pick a card that fits your lifestyle. If you’re traveling, a travel rewards card might make sense. If most of your spending is groceries and gas, look for cards offering bonus points there.

My roommate learned this the hard way — a $100 overspend one month snowballed into debt because they missed payments. Now, they’re much wiser and have a neat credit history going.

Save: Even Tiny Amounts Matter

Saving might feel impossible with tight student budgets. But here’s the secret: tiny amounts add up. Starting an emergency fund — even if it’s just $10 or $20 a week — builds a safety net worth having.

Why Bother Saving Now?

Life loves throwing curveballs — a broken laptop, unexpected travel, car repairs. Having a stash means you don’t have to scramble or go into debt. Plus, compound interest (yes, that’s a fancy term for your money quietly growing) makes that small weekly saving into a nice chunk over time.

| Monthly Save | 1 Year | 4 Years (College Span) |

|---|---|---|

| $50 | $600 | $2,800 |

| $100 | $1,200 | $5,600 |

If you’re just starting out, some banks offer student-friendly high-yield savings accounts with no fees — perfect for growing your stash. Bonus points if you’ve checked out the money management tips for students that emphasize setting realistic goals coupled with small regular savings.

Putting It All Together

So here’s the thing: managing your money as a student doesn’t have to be complicated or painful. It’s really about building good habits bit by bit, and being a little curious about your spending.

Start by tracking your expenses for a week or two. Next, set up a flexible budget that feels doable (not like a punishment). Cook some meals instead of eating out, find side gigs you enjoy, use credit cards wisely, and stash away some savings — no matter how small.

These steps form a sustainable approach and can carry you through school and beyond. For even more inspiration, I highly recommend checking out 25 financial tips for college students for fresh ideas and Money management tips for young adults to prepare for life after graduation.

What’s the one money move you’re going to try first? Drop a comment or start a simple expense log right now — you’ll be surprised at how empowering it feels. Your wallet (and future self) will thank you.