Why Does My Money Vanish?

Okay, honest question—have you ever opened your bank app and thought, “Wait… where did all my money go?” (Trust me, you’re not the only one muttering at your phone behind closed doors.) We all want to be “good” with money, but sometimes our cash seems to disappear like socks in the laundry. Let’s go there. I’m talking about bad financial habits—the sneaky routines and mindset traps that slip under the radar and quietly make our wallets lighter than bad fast-food coffee.

But here’s the thing nobody really tells you: most of us don’t actually learn this stuff in school. Maybe your parents grumbled about bills once in a while, but did anyone actually sit you down and explain how not to let your paycheck turn into a ghost? Me neither. So, consider this your friendly, slightly messy guide to understanding bad financial habits, real-life stories, and those tiny changes that add up over time. Not the shame, just the “wait, are we doing this together?” vibes.

Habits That Hide in Plain Sight

What Are We Missing?

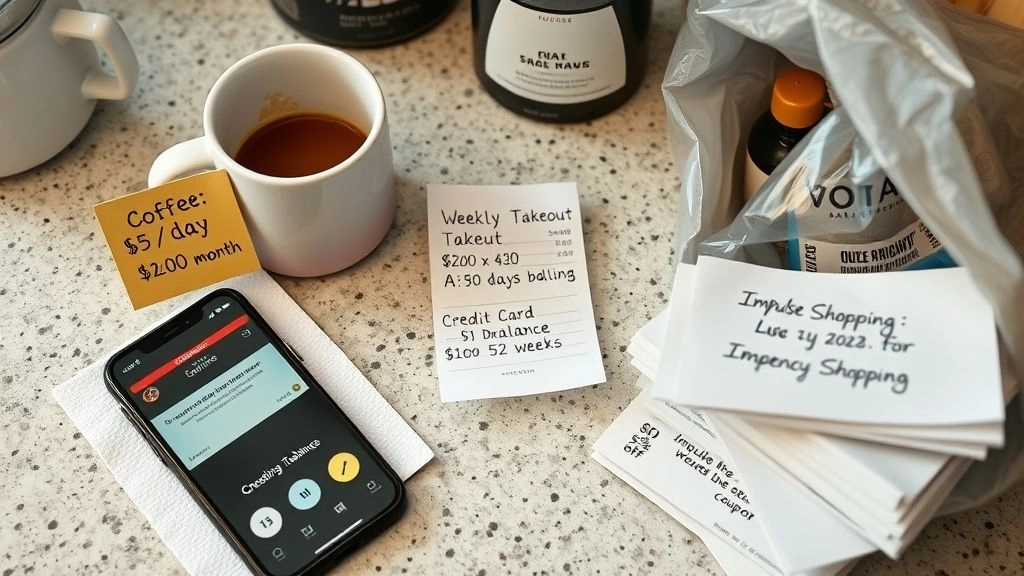

Let’s call it like it is: bad financial habits sneak in so quietly, you barely notice. Maybe you’re tired one night and splurge on takeout… then three times a week becomes “normal.” Or you see that sweet online deal—50% off!—and you click ‘Buy Now’ without thinking twice. Yep, been there. It’s how most bad financial habits examples start. No big, single disastrous purchase—just dozens of little ones… over and over.

And hey, it’s not just you. Even big financial sites admit: whether you’re Gen Z, a millennial barely treading water, or a boomer who hates online banking, money mistakes have no age limit. The research on spending habits shows we’re all just trying to muddle through, but certain traps catch way too many of us. Like, are you putting savings last? Living off credit cards? Ghosting your bills? (Don’t worry, confession time’s coming!)

Real Life: “Just This Once” Syndrome

Quick story. Last year, my best friend decided to track every “tiny” spend for one month. Coffee runs, streaming subscriptions, random gas station snacks. Guess how much? Over $800. She nearly fainted. It was all the things she’d told herself were “no big deal.” That wake-up call? Ouch. But also, it made budgeting real—not just a guilt trip.

Overspending—It Happens So Fast

When ‘Treat Yourself’ Gets Expensive

Ever find yourself buying stuff just ’cause it’s on sale, only to realize you didn’t really want it? Yeah. That’s the essence of bad financial habits: overspending, even when logic says no. You tell yourself, “I’ll just use my card and worry about it later.” Oops… next thing you know, you’re stuck with a balance bigger than your car payment.

Table: Bad Habit Fixes (Yearly Savings Guesstimate!)

| Bad Habit | Yearly Cost | Frugal Swap |

|---|---|---|

| Daily Coffee Shop | $1,200 | Home Brew ($350) |

| Weekly Takeout | $2,080 | Meal Prep ($600) |

| Impulse Online Shopping | $1,500+ | Wait 24 hrs + Wishlist |

That data might be just a ballpark… but seriously, those “small” spends? That’s a weekend trip—to Paris (or like, at least Portland). It adds up. If you want to go deeper into the nitty gritty, check out these 5 bad money habits to see which ones might be draining you specifically.

No Safety Net—Why Do We Do This?

Emergency Fund: Wishful Thinking?

Let’s be painfully real for a second… So many of us live paycheck-to-paycheck. The car breaks down? Dentist says, “Root canal!”? Suddenly you’re Googling “quick loans,” heart pounding. The experts at Experian and even personal finance nerds on Reddit all agree: having no emergency fund is maybe the biggest bad financial habit around. But it feels so… impossible, right?

Truth: saving is hard when you’re already stretched thin. But starting tiny—like, $10 or $20 a week—changes the game. Automation is your friend. Set up an auto-transfer. Forget about it. Next thing you know, a few months in, there’s $300 in your emergency stash. That’s peace of mind you’ll actually feel.

Storytime: The $657 Flat Tire Meltdown

A friend of mine—the queen of “I’m just bad with money”—got hit with a flat tire and a tow last winter. She didn’t have emergency savings… so she put it on her credit card. That card? Already maxed. Stress, tears, asking parents for a loan. If she’d just stashed a couple hundred bucks, she’d have skipped the drama. Moral: even an imperfect safety net beats none!

Credit Cards—Friend or Foe?

Are You Swiping on Autopilot?

Here’s the plot twist: credit cards can help your budget… or wreck it. (And no, it’s not all or nothing.) One of the most common 10 bad money habits you need to break today is swiping just because it’s easy, without tracking the “invisible” debt piling up. High interest? Haunts you for months, even years.

I used to treat my card like, “It’s fine, I pay the minimum.” Then the balance ballooned after a few late-night shopping sprees. It took months of budgeting and a big dose of reality to get out. If you feel the temptation, start carrying cash for everyday stuff. It stings more to hand over $40 than mindlessly tap your card. That “ouch” is your real budget talking.

Mini-Tip: Debt Avalanche vs. Snowball

You’ve probably seen both approaches. With the “debt snowball,” you pay off your smallest balance first for a psychological win. “Avalanche” means you go for the card with the highest interest first (saves more long-term). Either way? The goal is to stop debt from running your life.

Forgetting the Bills—Out of Sight, Out of Mind

Late Fees Love Hiding

Let’s talk bills. Yes, it’s boring. But if you forget or avoid opening them, that’s a classic setup for late fees, stress, and credit score headaches. It’s also one of those behaviors kids notice, and then copy—tough circle to break, huh? Organize, automate, or set “nagging” reminders (I literally put sticky notes on my mirror for months). You’ll thank yourself when those late fees disappear from your life.

Table: Ignoring Bills vs. Tackling Them

| Ignoring Bills | Healthy Financial Habit | |

|---|---|---|

| Short-Term | No stress at first | Quick peace of mind |

| Long-Term | Late fees, credit dings | No nasty surprises |

Want more ways to spot and fix these “stealth” bad habits? On those rainy Sundays, binge these 16 bad spending habits and feel a little less alone—and a lot more motivated.

Small Tweaks, Big Wins

What Actually Changes Things?

You don’t need to go full no-spend challenge to upgrade your money life. Those extreme stories? Fun to watch on TikTok… but not real for most of us. The truth is, one small change—like finally bringing your lunch three times a week—might actually stick. Before you know it, you’re the friend who’s always down to split a dessert and pay off a credit card early.

Personal confession: last year, I swapped “just picking up a coffee” for brewing at home. Not only did I save almost $1,000 in one year (wild, right?), I finally felt in control, like I was the one making the decision—not the caffeine cravings. Sure, I still “splurge” for Friday coffee with friends, but it’s on purpose now, not autopilot.

Roundup: The Healthy Stuff

There’s no magic bullet, but if you’re looking for a place to start, try these:

- Set up a budget (however basic—napkin math counts!)

- Automate an itty-bitty transfer into savings each payday

- Review subscriptions—ditch one you forgot about

- Pause online shopping carts for 24 hours

And hey, science agrees: small habits repeated over time beat willpower battles every day. If you need more inspiration, the folks at healthy financial habits have a great list of simple ways to build better routines. Even if it’s “messy progress,” you’re doing more than you think.

You’re Not Alone (Seriously)

Why None of This Is About Shame

Here’s the (maybe weird, maybe comforting) truth: everyone—yep, literally everyone—has made money mistakes. Some people just… hide it better. Others learn to laugh, dust themselves off, and try again. Bad financial habits are sneaky and persistent, but so are you. Have you noticed you’re more motivated after hearing an honest story than after a lecture? Me too. That’s why sharing these little wins and fails matters.

If you want more peeks into what trips people up, these bad financial habits examples are like looking in a mirror some days. We’re all human. And it’s never too late to try a new approach (even if it’s just… checking your subscriptions one more time tonight).

Let’s Wrap This Up—On a Hopeful Note

So? Here we are—less cash lost to “just this once” decisions, a little more hope, and maybe even the first real step toward healthy financial habits. If your wallet has ever haunted you (“where’d it all go??”), remember: progress isn’t about perfection. It’s a slow pile-up of tiny changes, good laughs, and the occasional slip-up.

As you start spotting those bad financial habits—maybe killing a few, maybe just being more honest with yourself—give yourself some credit. Imagine what happens after a month of swaps. Two. A year. What’s just $5 a week now… could turn into your next getaway, your freedom from paycheck panic, or just a good, solid night’s sleep. That’s real. You deserve it.

My nudge? Pick one thing to try this week. One habit. Write it down. (Or type it in your phone, it’s 2025 after all.) Tell a friend, or shout at the cat. And when you hit that first mini-goal—buy yourself an extra treat. On purpose. Because control, not guilt, is the best feeling in the world.

What bad money habit are you leaving behind? Or which healthy swap are you excited to try next? Let me know—and hey, let’s make money less stressful and way more human, together.