What if you could skip the endless Googling, sort out your budget once and for all, and actually feel like you’re learning—without your eyes glazing over at boring finance jargon? Here’s the real deal: a money habits quizlet isn’t just a pile of flashcards, it’s a smart way to practice, remember, and actually use better money habits (yep, even when life gets messy).

So, if you’ve been hoping for clear answers, practical examples, or just a little less confusion when it comes to banking, budgeting, or sorting through “needs” vs “wants”—you’re in the right spot. Pull up a chair, relax your shoulders, and let’s untangle money habits together. (And hey, you might even crack a smile along the way.)

Why Flashcards Work For Money

Ever stared at a “budgeting” article and zoned out after the second paragraph? I get it. But stick with me—because flashcards can be like giving your financial skills a jumpstart, one bite-sized question at a time. Instead of drowning in walls of text, a money habits quizlet lets you quiz yourself on budgeting, saving, and goal-setting… in minutes, not hours.

Think of it like this: learning money habits is kind of like learning a language. You won’t wake up fluent, but with the right prompts (and a little repetition) everything starts to click. Quizlet-style learning means you’ll review, check yourself, and (best part) build confidence to use what you learn in real life. Not just pass a test.

What People Want From A Money Habits Quizlet

Let’s get right to the point. What’s everyone looking for when they search up “money habits quizlet” or “smart money habits Everfi quizlet”?

- Fast answers to real questions: What’s a budget? How do I save? What are short- or long-term goals?

- Easy revision: For Everfi tests, high school modules, or “adulting 101” checklists.

- Ways to check your progress: Not just memorize—see if you actually “get it.”

And honestly, who doesn’t want a little cheat sheet when those tricky concepts pop up? Budgeting, saving, “balancing expenses and savings Everfi answers”—Quizlet cards cut through the noise. Just be careful: not every card set you find online has accurate info, so always double-check (especially for things like everfi smart money habits answers or lesson-specific questions).

Core Money Habit Flashcards: The Must-Haves

Let’s talk about what’s actually essential on your cards if you want to upgrade your own habits. Here’s what works (and what most of us wish we’d learned in school):

- Definitions you’ll actually use: Budget, saving, spending, emergency fund, fixed expense. Not just definitions—real examples make a difference.

- Needs vs. Wants: Sounds simple, but when you’re holding up a pair of new sneakers, can you really tell the difference? (A tip: ask “will this help me survive, or just make me smile for 10 seconds?”)

- Short-term vs. long-term goals: Like, “buying a phone” vs. “saving for college.” Everfi typically says a short-term goal is within a year—super handy to know for quizzes everfi grow financial planning for life post assessment answers.

- How to balance expenses and savings: This one’s gold. Imagine putting away even $5 before treating yourself. Your future self will want to hug you.

I know—some of this sounds basic, but the best money habits are the ones you’ll actually do when you’re stressed, tired, or super busy. That’s why flashcards work: muscle memory for your wallet.

Everfi & Smart Money Habits: What To Expect

Everfi has become the gold standard for high school money smarts (also, more and more adults are sneaking back for the refresher!). What are you likely to see in a “smart money habits Everfi quizlet” or “Everfi financial literacy for high school answers module 1” set?

- Examples of smart spending (“Is it a need, or a want?”) and practical saving tips.

- Goal setting—breaking goals into actionable, time-framed chunks.

- Step-by-step budgets—not the spreadsheet apocalypse, just: what you earn, what you spend, what’s left each month.

- Habit-change scenarios, like how to fix an overspending month, or set up an emergency fund.

If you need ready-to-go answers or want to cross-check yourself, peek at everfi smart money habits answers and review official materials whenever you can. Remember, passing the test is cool, but becoming un-tangleable when life throws you a curveball? That’s next-level.

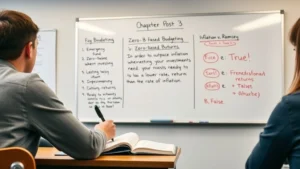

Budgeting & Goals—How Flashcards Make It Happen

I’ll be honest, the first time someone told me to “just start a budget,” I kind of froze. Like… how? Do you need a PhD in spreadsheets? But there’s a simple card that changed everything for me. Here’s what it looked like (imagine it as a flashcard):

| Front | Back |

|---|---|

| How can a budget help you reach your financial goals? | Keeps you from overspending, helps you plan for big stuff, and shows you if you’re on track—like a GPS for your money. |

| What should you do if your expenses are higher than your income? | Cut non-essentials first, switch up your habits, and look for ways to boost income. |

| What’s usually in a basic budget? | Income, fixed costs (like rent), variable costs (like snacks), savings goal, something for fun. |

Doesn’t that feel less scary? If you want to dig deeper into budgeting flashcards, budgeting everfi quizlet is a great set to review. You’ll find everything from “how to track expenses” to “how to set a real goal.” No fancy calculator needed.

Learning FAST: Practical Quizlet Study Tips

Don’t worry, you do not have to study for hours…unless that’s your jam. Want to get the most out of your “money habits quizlet”? Here’s what’s worked for me (and for a bunch of real people who needed to stop the paycheck-to-paycheck rollercoaster):

- Mix up question types (facts, real-life what-would-you-do, “explain it to your little brother”) for better recall.

- Don’t just skim—pause and truly check if you know the answer, not if you can guess right with one eye closed.

- Do “spaced repetition”—come back to the toughest flashcards 2-3 times a week for a quick brain boost.

- Create your own cards after you finish a lesson—especially if you’re working through modules like “Everfi financial literacy for high school budgeting answers.”

- If you’re prepping for an Everfi assessment, build cards around “big” concepts: needs vs wants, saving strategies, emergency funds, balancing savings and expenses, modules from everfi grow financial planning for life post assessment answers.

And always—always—test yourself in “real life.” Next time you’re about to spend on something big, try this: say your flashcard answer out loud. (If you get a strange look for talking to yourself in Target, trust me, nobody’s really paying that much attention.)

Benefits & Pitfalls—Keeping It Real

Alright, let’s get super honest here. Using a money habits quizlet (or any flashcards) is like drinking coffee before an early morning—instant kick, but you still have to do the work. The good?

- It’s quick, low-pressure practice—for tests and real life.

- You can spot gaps fast—like, “whoops, I still don’t really get compound interest!”

- You actually retain (not just “cram and forget”).

The not-so-good? Sometimes, what’s on a flashcard is too simplified or even, let’s say, a bit off. Not every “smart money habits Everfi quizlet” set you stumble upon online will have perfect info. So, always use official lessons, teacher advice, or your school’s guidelines as backup—especially when you’re hunting for everfi smart money habits answers.

There’s also the risk you get tricked into thinking “I memorized it so I’m a money genius now.” Real power? That comes when you apply your answers in the chaos of real life—late-night cravings, last-minute shopping, or dreamy new gadgets. Flashcards get you ready; your daily choices seal the deal.

Real Story: When Money Habits Click

I used to think saving was all-or-nothing—like, either I magically “had it together,” or I was doomed to be broke. But my first real flashcard breakthrough was a simple habit: every paycheck, I moved $20 into a “can’t touch” savings bucket. Some months that was it. Others, I surprised myself and did more. After a year—I kid you not—I covered a car repair with my own cash. No borrowing, no panic.

I know a high schooler who made a game out of flashcards—turning “module 1” into riddles and rewards with her friends. Turned out, the one who could explain budgeting in their own words ended up helping their little cousin open a savings account that summer. Teaching is the ultimate test, I guess.

Simple Plan: Turn Knowledge Into Habit

Here’s a gentle nudge—a mini-plan you could actually stick with (promise):

- Day 1: Build or find a 20-card “money habits quizlet” set focused on spending, saving, and budgeting basics.

- Day 2-4: Practice 5-7 cards a day—mix in a real scenario: “How can a budget help you reach your financial goals?”

- Day 5: Write your own flashcard for something that tripped you up. (For example: “How do I track small purchases?” or “What’s one step to fight impulse spending?”)

- Day 6-7: Review your weakest cards. Try applying one in real life—a small save, a skipped treat, or even explaining a “want vs need” out loud when making a choice.

Repeat next week. Tweak as you go. The goal isn’t perfect memorization—it’s just getting a little bit less lost (and a lot more confident) with every round.

Key Takeaways: Keep It Relatable, Make It Yours

If you remember nothing else, let it be this: Money habits aren’t about being flawless. They’re about using tiny, simple reminders (“hey, check your budget!”), catching yourself before you slip, and celebrating the days you get it right. A good money habits quizlet helps you think smarter and act smarter—without judgment.

So next time you’re up late, crunching numbers, or tempted to splurge, pause for a second. What would your flashcard say? And if you need a boost, grab a fresh set, quiz a friend, or check out the resources at everfi smart money habits answers, everfi grow financial planning for life post assessment answers, or budgeting everfi quizlet.

You’re building something better—one choice, one flashcard, one habit at a time. And trust me, you’re already doing better than you think. Keep going. If you ever wonder “Am I really getting this?”—you are. And if you’re ever stuck, come back here. We’re all learning, together.